Top 5 Barclays Sales and Trading Interview Questions

Last Updated:When I'm asked about sales and trading platforms that fly under the radar, I always bring up Barclays. Despite a turbulent (to put it lightly) period through the great financial crisis, Barclays has right-sized their trading operations and is one of the strongest non-U.S. domiciled trading platforms.

While Barclays doesn't show up strong on many league tables, this is primarily because they aren't as concentrated in any one category. However, in recent years Barclays has made a real push in the securitization and credit space and has expanded out their fixed income division (which has group multiple-fold, by revenue, over the past few years with a 53% rise in net income in Q1 2021).

If you're looking to jump into sales and trading in London, Hong Kong, or New York then Barclays is a strong choice. Obviously, London will have the largest trading floor, but New York has been snatching up many laterals in the credit space from places like Goldman Sachs and J.P. Morgan.

While Barclays will provide a strong platform regardless of what you want to do in traditional sales and trading, I would personally recommend looking to Barclays if you're inclined toward credit S&T, rates S&T, or securitization.

Barclays Sales and Trading Interview Questions

The following are some of the questions you can expect in an interview at Barclays. Feel free to click the links below to navigate to the questions.

Keep in mind that your interviewer could ask you more specific product questions based off of the desks you express an interest in. That's why the Sales and Trading Interview Course contains desk-specific guides with the basic questions and answers you'll need to know (along with hundreds of other more general questions).

Question 1: What is delta in the context of options math?

Question 2: What will inform the trading price of a corporate bond

Question 3: What kind of clients would come to us to buy corporate debt in S&T?

Question 4: What's a credit spread?

Question 5: What's commercial paper?

What is delta in the context of options math?

Chances are you've heard of the "greeks" as it relates to options. These greeks in reality are just partial derivatives of the option pricing model, which the four most notable being: delta, vega, rho, and theta.

To put it more simply: the greeks tell us how much the option value changes when one of the inputs is changed (with everything else being kept the same).

Delta is the most famous of the greeks because it is measures the change in the value of the option (like all the other greeks do) when a change in the underlying occurs (with nothing else changed).

Delta is important because it informs how, for example, an equity derivatives trader will hedge their position to stay delta neutral (not make or lose money based off of changes in the underlying the option was written on).

This is crucial because, as I've stressed many times, the role of a market maker in modern sales and trading is to clip a spread and take very known risk. It's far better to just do lots of volume, always taking a fee / spread for doing so, and then getting rid of the risk by hedging out as opposed to building up a book of lots of different risk from lots of different options (that's how you have famous tail-risk events that end up blowing your book up).

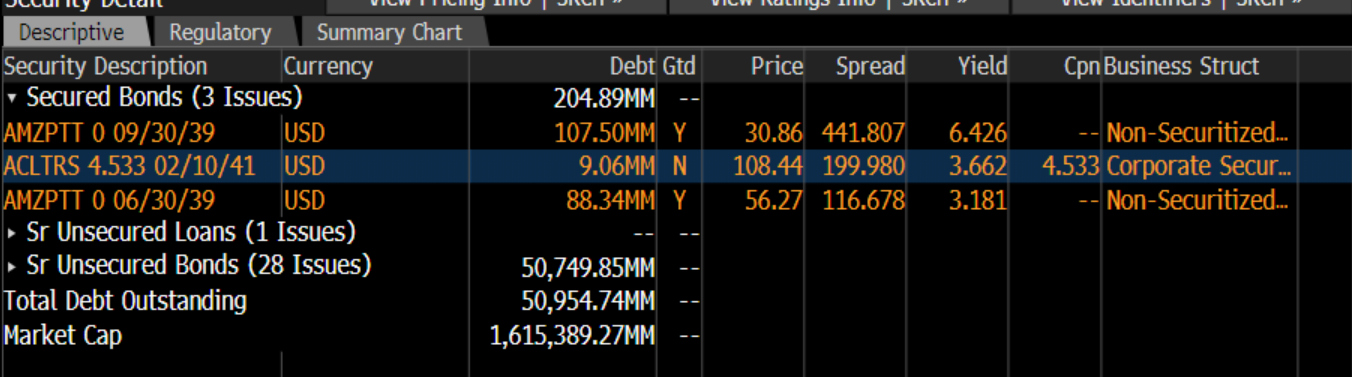

What will inform the trading price of a corporate bond?

This is a typical question because it's so broad and doesn't have any one objective answer (since there are many things that can inform bond trading price levels!).

The first thing you'd look to is the broader credit market. During times of tumult in the credit markets, you'll have prices go down and yields go up regardless of the underlying credit quality (as we saw in early 2020).

Second, you'd look to recent news about the issuer of the bond and how that could inform the pricing. For example:

- Have they been downgraded by a credit rating agency?

- Do they have declining free cash flows?

- What has been their revenue, EBITDA, and net income growth (or decline) rate? Is it accelerating in the wrong direction?

- Are they part of a structurally or cyclically declining industry?

Third, you may want to bring up the limited liquidity many corporate bonds have. If a large holder is working out of their position - not for necessarily bad reasons! - that can create downward pressure on the bond that is unrelated to its fundamentals. It's just when you have illiquid markets that are lopsided (more selling than buying) you can have depressed pricing on the market for some period of time (usually a few days until this little arbitrage, if you want to use that word, is worked out).

What kind of clients would come to us to buy corporate debt in S&T?

This is a great question because at first blush you might just start blurting out a few types of clients, but you need to take a step back and think about the question a bit more.

Corporate debt is a broad term and could mean the question is referring to clients who are going to the investment grade desk, the high yield desk, or the distressed debt desk (assuming the high yield and distressed debt desks are separate, as they often are).

In general, you'd expect the kinds of clients coming to buy corporate debt to be:

- Hedge funds

- Pension funds

- Sovereign wealth funds

- Endowment funds

- Credit funds tied to large private equity funds

- Banks

For investment grade debt, you'll have all of these clients, but hedge funds are likely to be relatively small (as not many hedge funds are actively buying in and out of investment grade debt given how little volatility there is there).

For high yield and distressed debt, you'll have much less client activity from pension funds, sovereign wealth funds, and endowments due to most of these clients not having the mandate to deal with overly distressed debt (due to the liquidity and inherent volatility).

Instead, for high yield and distressed debt chances are the most frequent clients you'll be dealing with are hedge funds and the credit funds of large private equity funds.

So, to be clear, when answering this kind of question you need to be a bit careful. Don't rush into your answer, because the trick is realizing that various kinds of desks deal with various kinds of corporate credit and the kinds of clients dealt with will be quite different.

What's a credit spread?

As laid out in the larger sales and trading post, you should always be prepared for some technical questions that have objective answers.

A credit spread is just the difference between the yield on the corporate bond you're looking at and the treasury of similar duration.

Note: Obviously, for a credit spread on a U.K. issuer you wouldn't use a treasury, but rather the relevant maturity of whatever gilt.

What's commercial paper?

Barclays is relatively active in money markets -- both issuing money market securities on behalf of clients, which is done out of debt capital markets (DCM), and trading money market securities.

Commercial paper is one of the most popular forms of money market securities. Commercial paper is very short in duration and is issued by companies who don't want to hold a lot of cash, but may have financing needs that arise so they need a relatively small, short-term injection of cash.

In return for folks buying commercial paper issued by corporates, they'll get a modest return. While the return is modest to holders of commercial paper, it is better than holding cash itself (which is not providing any return!).

So commercial paper is a way for those with cash to earn a modest return while taking on very little credit risk and for those that need cash (to fund a short term shortfall in cash) to get some while paying very little to do so.

It goes without saying that those corporate issuers of commercial paper tend to have very strong credit ratings and are viewed as having an incredibly low probability of default (although the financial crisis of 2008 showed how risks in commercial paper are most certainly non-zero!).

Corporate who routinely issue commercial paper - like a subsidiary of Barclays themselves - will have this paper rated so that buyers have further insight into the credit quality of these short term securities.

Note: At Barclays within the sales and trading division there will be a money markets desk that deals with short term securities like commercial paper, repo, etc.

Conclusion

While Barclays is no longer as near the top of league tables as they were prior to the great financial crisis, they still offer a phenomenal program to join (in particular in London, but also in New York and Hong Kong).

In particular, if you're thinking about Barclays I'd focus on credit trading, rates trading, and securitization as those have been strong areas over the past few years and have seen significant growth (in headcount and in revenue).

As I've said many times before, don't get too caught up in what bank you join. In particular if you're just joining out of undergrad. Within sales and trading - unlike in traditional investment banking - you'll have the capacity to lateral to other banks so long as you can prove you've been trained well, have a rationale for moving, and can contribute to your new team.

As I also mentioned earlier in this article, Barclays has been snatching up people from more "prestigious" sales and trading divisions over the past few years in the credit space so that is generally a good sign of where you want to be.

If you're gearing up for an interview at Barclays, I hope these interview questions have been helpful! If you're looking for hundreds more, be sure to check out some of the other sales and trading interview questions I've posted or get all the questions you'll ever need to know as part of the S&T Interview course.