National Bank Sales and Trading Interview Questions

Last Updated:In August there was an increasing consensus that we were observing a soft landing in real-time: not only was inflation fluttering down from its (extremely) elevated levels, but so too was growth. This was the ideal recipe, as the low levels of growth anticipated to occur in Q3 2023 and Q4 2023 would act as a damper and ensure that inflation didn’t spike back up above expectations again – and then, in Q1 2024 or Q2 2024, the Fed could begin lowering rates ever-so-slightly to stimulate growth and ensure that the economy didn’t lapse into recession.

This framework was the rationale behind equities embarking on their march upwards through the summer: a belief that not only are rate hikes in the rear-view mirror, but that the yield curve would collapse (in yield terms) across the curve as rates normalized.

However, this elegant framework has had a wrench thrown into it and, today, the macro landscape is decidedly more muddled. Inflation has continued to come in-line with expectations, albeit with headline PCE overshooting estimates a bit last month, but the level of growth the economy is experiencing has taken everyone by surprise.

To provide a sense for how much of a surprise this has been, in the middle of August the expectation for Q3 2023 GDP growth was around 0.5% but the actual print was nearly 10x that (4.9%). During this same time, as folks have begun to internalize how resilient the economy is, the long-end (30-year) has risen 70bps and the S&P has fallen 321 handles.

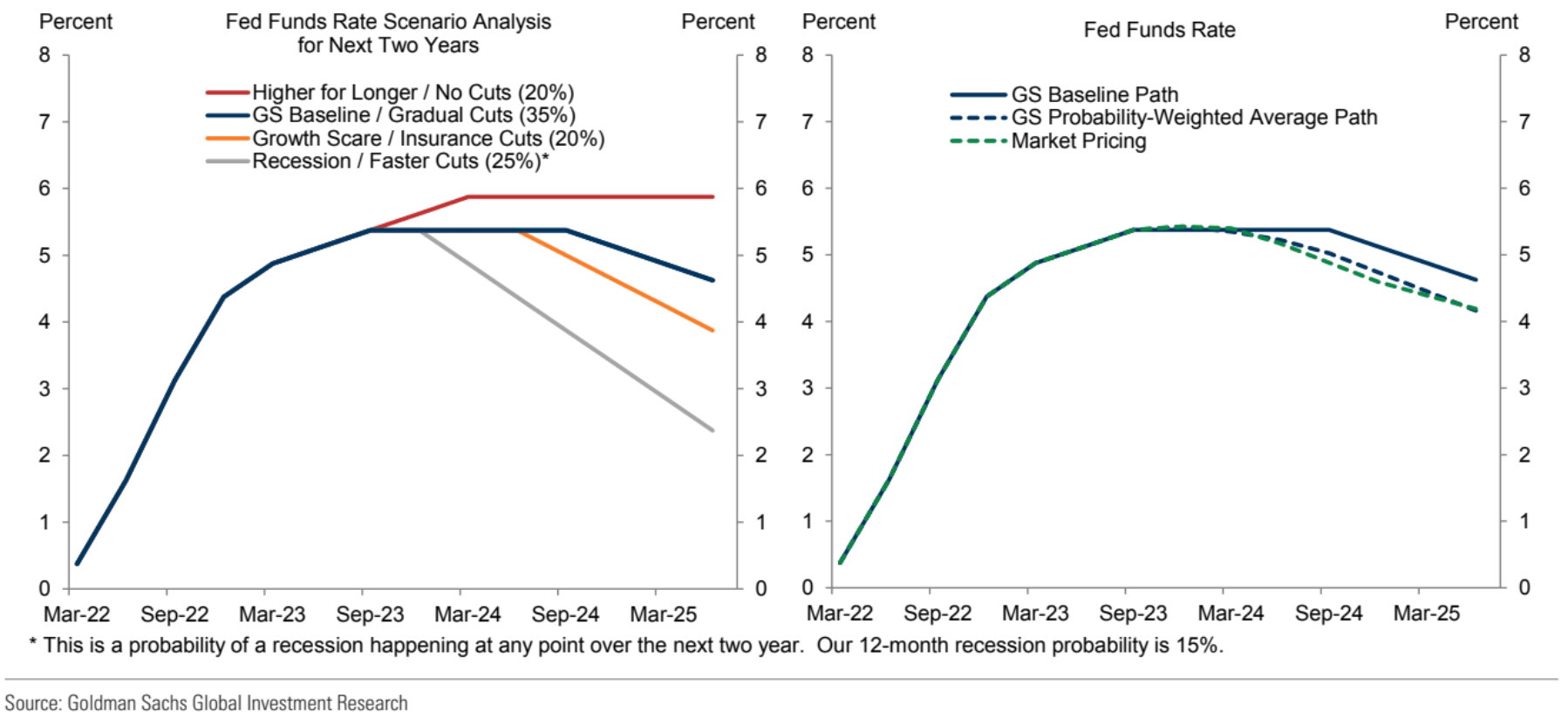

Given that for the last two years the conversation has been all about when the Fed would be done raising rates, it’s a bit ironic that now that the market consensus is that the Fed won’t raise rates no one cares too much (the market is pricing in only a 20% chance of a 25bps hike for the December meeting).

And this is because the combination of yields spiking across the curve and equities falling in recent months has tightened financial conditions. In fact, the level of tightening we’ve seen since the middle of August is roughly equivalent, per Goldman, to 75bps worth of rate hikes.

There’s been much discussion in recent weeks about how Fed speakers have been all but admitting that no future hikes are coming with some like Mester saying, “We are likely near or at a holding point on the federal funds rate.” However, this dovishness stems from the market doing some of the Fed’s work for it in tightening financial conditions, and this is the reason that the market has largely looked through this more dovish rhetoric. The Fed may be done tightening financial conditions themselves, but that doesn’t mean that financial conditions won’t tighten further.

Here's Alan Stewart (Co-Head of EMEA EM + FX One-Delta Trading) put it in a recent desk note: “The now well understood shift in the Fed’s language to recognize FCI tightening implies to me a willingness on their part to be more patient with the incoming data before committing to further tightening.”

National Bank Sales and Trading Interview Questions

Below are three market-based interview questions that’ll be similar to those asked in a sales and trading interview (albeit a bit on the tougher side). As mentioned in my posts on CIBC and Scotiabank in recent months, if you’re interviewing in Canada then make sure to know what the BOC is anticipated to do at its next meeting, where major economic indicators are, etc. However, it’s more than fine for your answers to open-ended market-based questions to focus on US-centric themes and trends – this holds true no matter where in the world you’re interviewing, but it’s especially true when you’re interviewing in Canada as US markets heavily inform Canadian market movements.

- Most Are Thinking There Will be a Slowdown in GDP Growth in the Next Few Quarters. But What Could Cause GDP Growth to Surprise to the Upside vs. Expectations in the Near-Term?

- What’s Driving the Moderation in Inflation Today?

- If a Recession is Avoided, Do You Think That Inflation Is Likely to Increase Once Again?

Most Are Thinking There Will be a Slowdown in GDP Growth in the Next Few Quarters. But What Could Cause GDP Growth to Surprise to the Upside vs. Expectations in the Near-Term?

There’s no one calling for a repeat of the Q3 GDP print in Q4 (although, in a repeat of last quarter, the Atlanta Fed GDPNow estimate of over 2% growth is significantly above the estimate of analysts that’s currently below 1%).

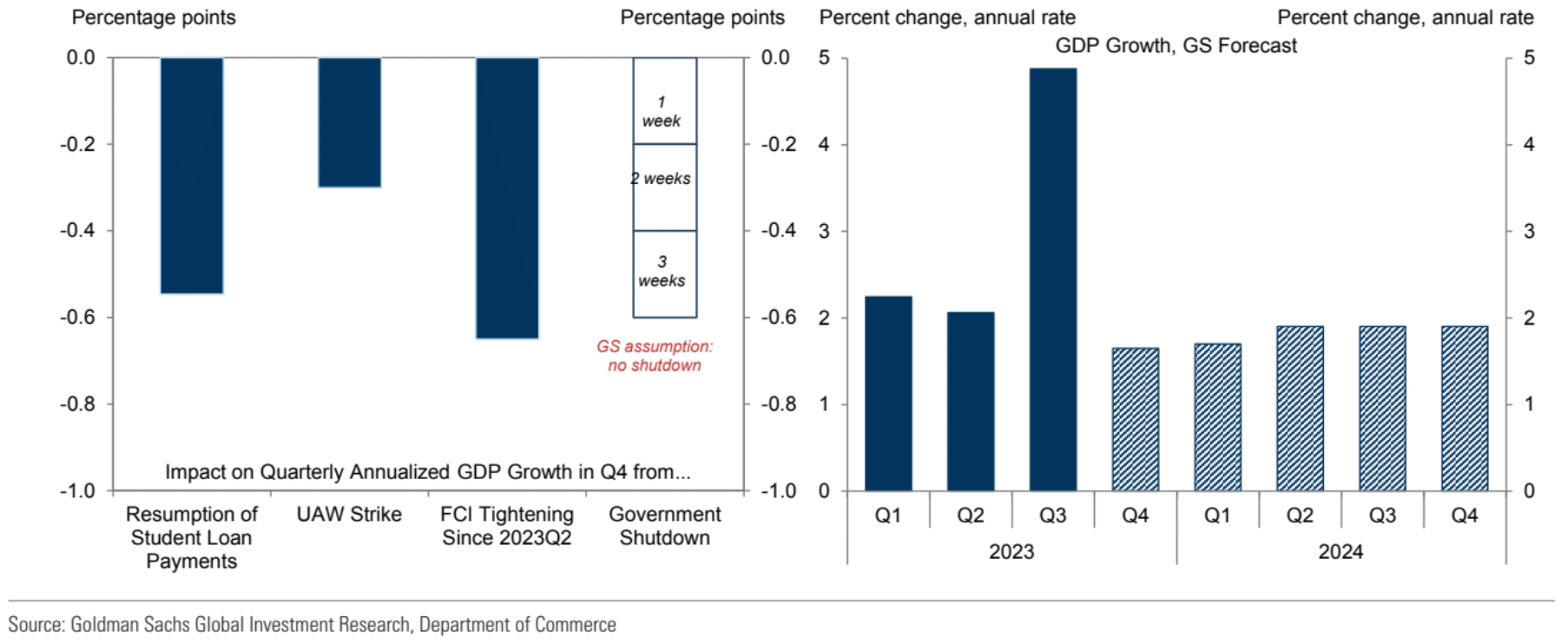

However, in a recent note for Goldman they boosted their already-above-consensus Q4 GDP forecast from 0.7% to 1.6% due to changing their views on the likelihood of a US government shutdown from very likely last month to very unlikely this month, the belief that UAW strikes won’t be as disruptive as initially thought, and credit card spending data illustrating that consumers continue to have the propensity to spend, spend, spend.

For the uninitiated, Nov. 17 is the deadline for issuing another temporary extension of spending authority and avoiding a shutdown. GS viewed it as being relatively unlikely that Congress would avoid a shutdown only a few weeks ago – but now has had a change of heart and believes the most likely case is that Congress kicks the can down the road through short-term funding extensions for the rest of the fiscal year (until 2024).

The primary reason for this change of heart stems from the election of Speaker Johnson who has expressed openness to passing a “continuing resolution” that would see the federal government being funded to the same tune as the prior fiscal year (so the fiscal stimulus taps would stay firmly open).

Goldman is still expecting some drag QoQ from the resumption of student loan repayments (that is baked in, and not going to change), the UAW strike (0.3% GDP hit), and the FCI tightening we’ve seen since Q2 2023 (0.75% GDP hit).

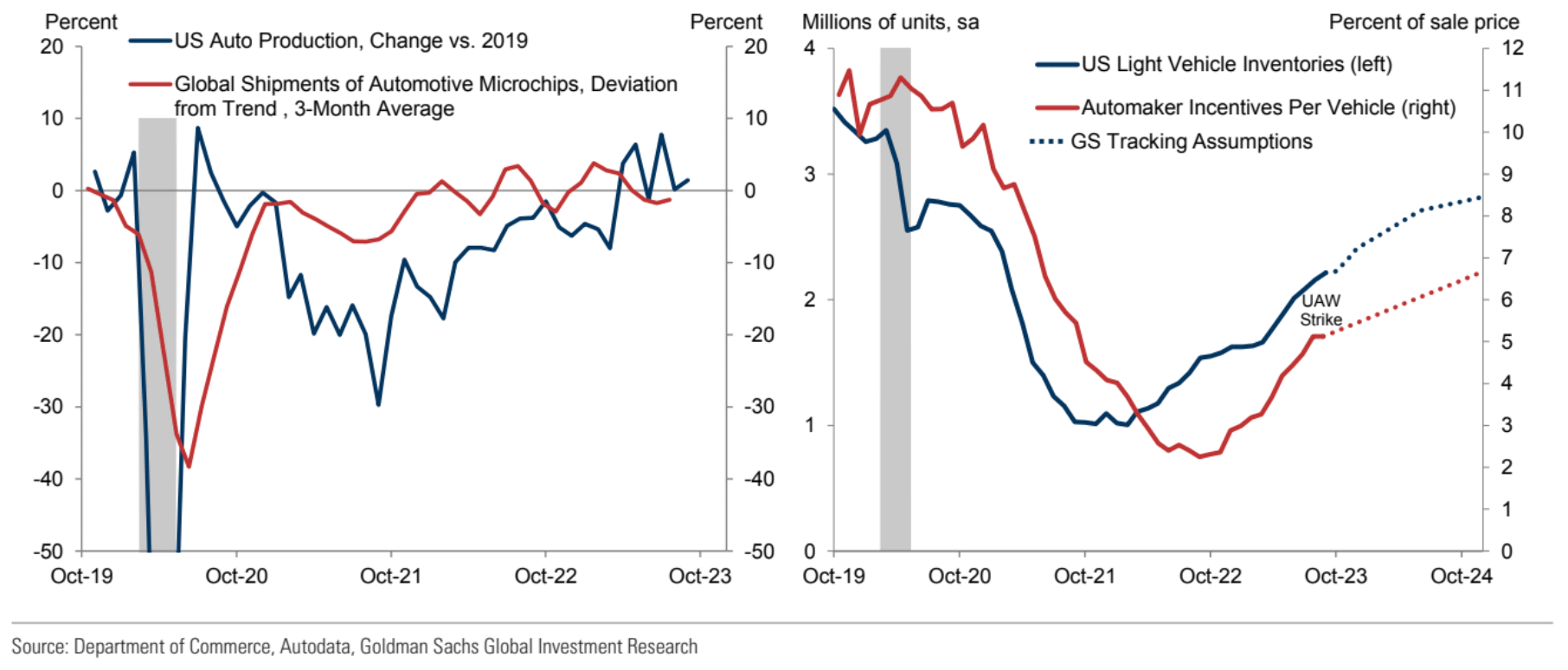

However, they’ve left the door open to being wrong on how much of a drag the UAW strikes will be because the tentative agreements reached suggest that the strikes could end soon, and if production is made up for in Nov and Dec that could be worth 0.1-0.3% of a QoQ GDP increase relative to their base forecast of 1.6% for Q4 GDP.

Additionally, the base case assumption of most, including GS, is that retail sales will fall into Q4 from its very elevated levels in Q3. But credit card spending data is showing that consumers are still spending, and if it doesn’t slow into the holiday season that could, per GS, represent a 0.5% upside to their base Q4 GDP forecast.

Finally, as mentioned, the biggest drag on Q4 2023 and Q1 2024 GDP will be the level of tightening in financial conditions – not driven by the Fed, but driven primarily by yields across the curve rising so significantly (that feeds through into the “real” economy through things like mortgage rates). However, if we see a sudden shift with financial conditions loosening – perhaps due to inflation data coming in well below expectations – then that too could feed through into stronger-than-expected economic growth in future quarters.

What’s Driving the Moderation in Inflation Today?

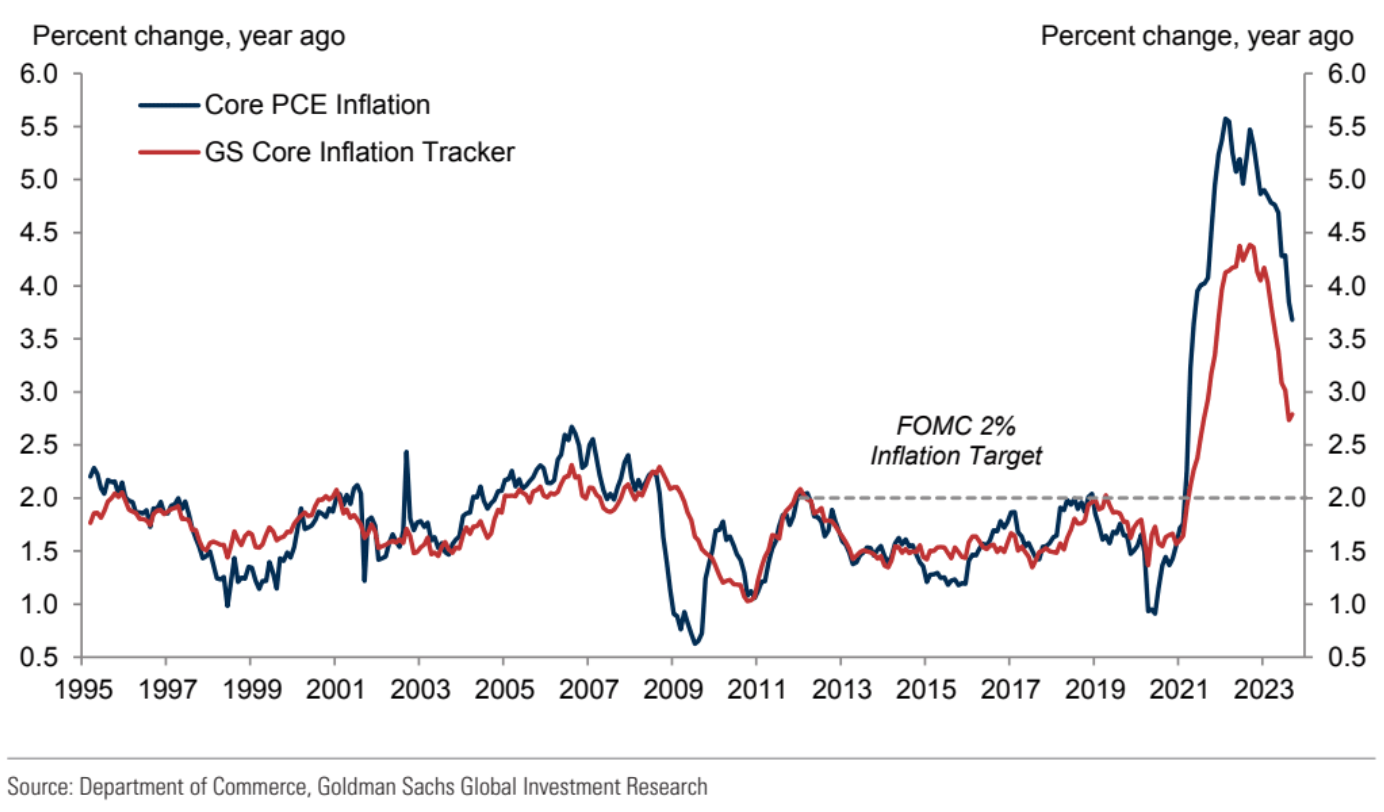

To the surprise of many, there has been an almost immaculate fall in inflation this year. This is all the more remarkable because it’s occurred during a time of economic growth that’s consistently surprised to the upside.

Core PCE, that’s often called the Fed’s preferred measure of inflation, was in the 5-5½ range in 2022 and came in at 3.7% YoY in September. However, if you look at trimmed measures – like core services ex-housing, healthcare, and financial services – we’re looking at a rate of around 2.9% which is getting pretty close to the Fed’s target. (It’s always a dangerous game to slice and dice inflation data too narrowly but it does make sense to look at core minus housing, healthcare, and financial services since their measurements are all lagged).

There are many theories as to what’s driven this immaculate fall in inflation. However, the strongest theory that, full disclosure, I wasn’t a huge believer in when it was first proposed comes out of Goldman.

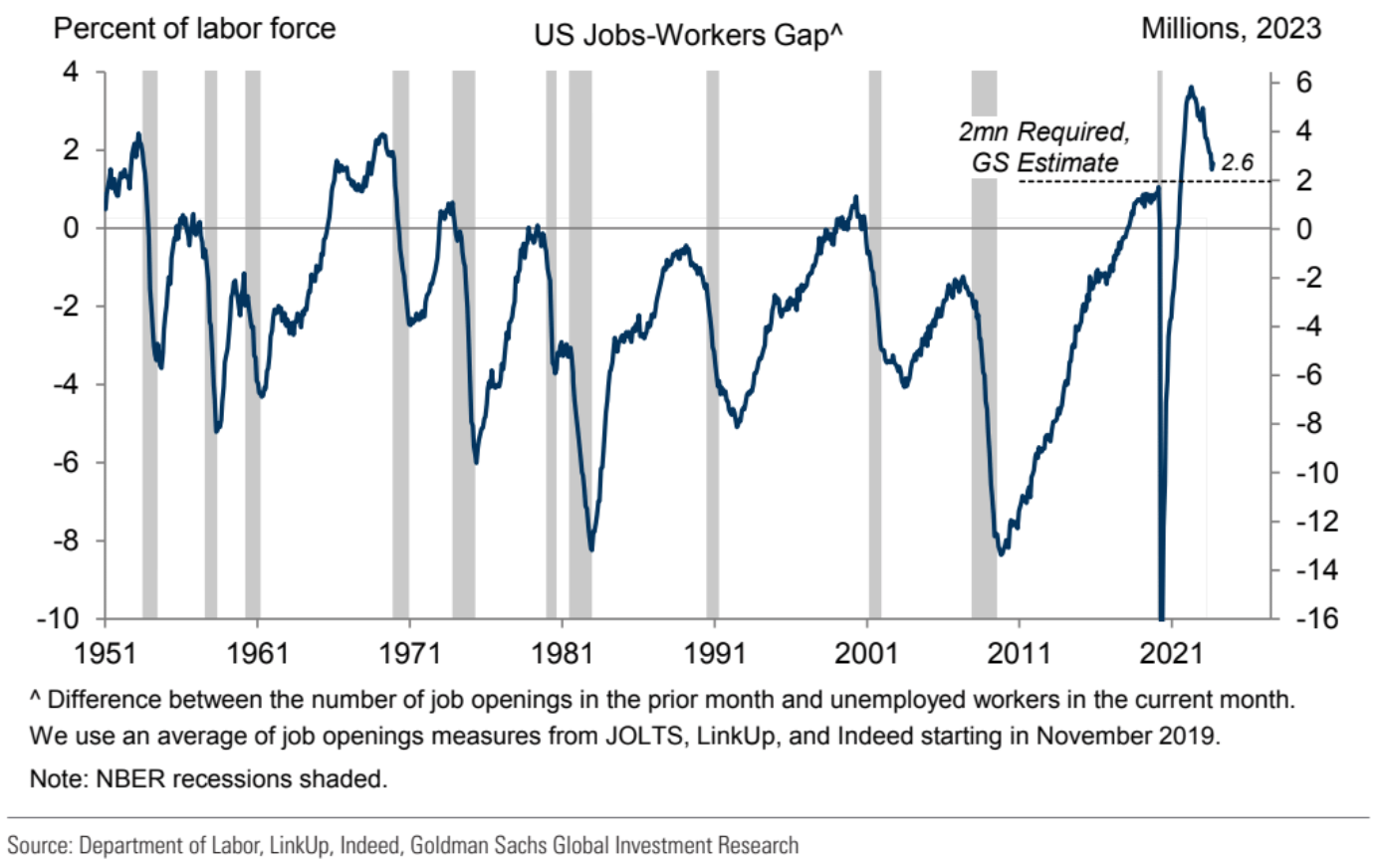

GS believed that inflation would moderate – almost irrespective of the underlying strength in the economy – if only there would be a labor market rebalancing. This isn’t too controversial if what they meant by “labor market rebalancing” was a rise in unemployment, since everyone would agree that an uptick in unemployment, or a recession, would wash out the inflationary dynamics of 2021-2022.

However, Goldman’s theory was that there didn’t need to be any rise in unemployment to see a fall in inflation back down to the Fed’s target over time. Instead, there just needed to be a fall in the jobs-workers gap because, the thinking goes, if that gap closes then workers will have less bargaining wage power, so wage increases will moderate, and there will be less of a rise in aggregate demand.

Put more simply: to ensure that inflation doesn’t remain elevated moving forward, but instead moderates to its baseline of the past few decades at around the Fed’s target, the job-workers gap falling is only thing that needs to happen according to Goldman’s theory.

To this end, we’ve seen a strong labor market rebalancing (using Goldman’s definition) with the job-workers gap falling from a peak of six million to around two-and-a-half million, and GS believes that a gap of around two million is consistent with an overall level of wage inflation of 3-4% which is consistent with an overall level of inflation of 2%.

Additionally, as the job-workers gap has closed we’ve seen a fall in wage inflation despite the labor market remaining exceptionally tight across most measures with continuing staying near cycle lows. The rationale GS would give for this occurring is that even though the economy is at full employment, if there are suddenly limited alternative jobs a worker could move to, then their bargaining power is severely diminished (i.e., it’s harder to demand that your employer give you a 10% raise when there’s no alternative employer that’d give you a similar bump in compensation!).

There are, of course, other contributing factors to the fall in inflation that we’ve seen: excess savings from the pandemic are dwindling (although there’s arguments over how exactly to measure these), many one-off factors that led to the rise in inflation like supply chain disruptions are abating, technical elements of CPI calculations like the lag in shelter are contributing to the lower YoY values we’re seeing, etc.

But there’s no getting around the fact that if wage inflation exhibited more stickiness, than we’d be seeing a higher level of overall inflation. The fact that wage inflation is beginning to moderate, even though the overall employment picture is still strong, is best explained by Goldman’s job-workers gap theory and that’s why in recent months they’ve been taking a not-so-subtle victory lap in all their notes.

If a Recession is Avoided, Do You Think That Inflation Is Likely to Increase Once Again?

There’s no free lunch, and it’s natural to believe that if the economy continues to grow at a relatively strong clip (as Goldman thinks) and that full employment will remain intact (as Goldman also thinks) that it’s unlikely that inflation will continue its immaculate journey back to target. However, this is exactly what GS thinks with core PCE falling to 2.4% by the end of next year without the need for any additional rate hikes (something that the Fed would be more than happy to see occur).

The reason for this is that Goldman believes that not only will wage inflation remain constrained due to the job-workers gap continuing its decline, but that there are going to be sources of substantial downward pressure on inflation next year.

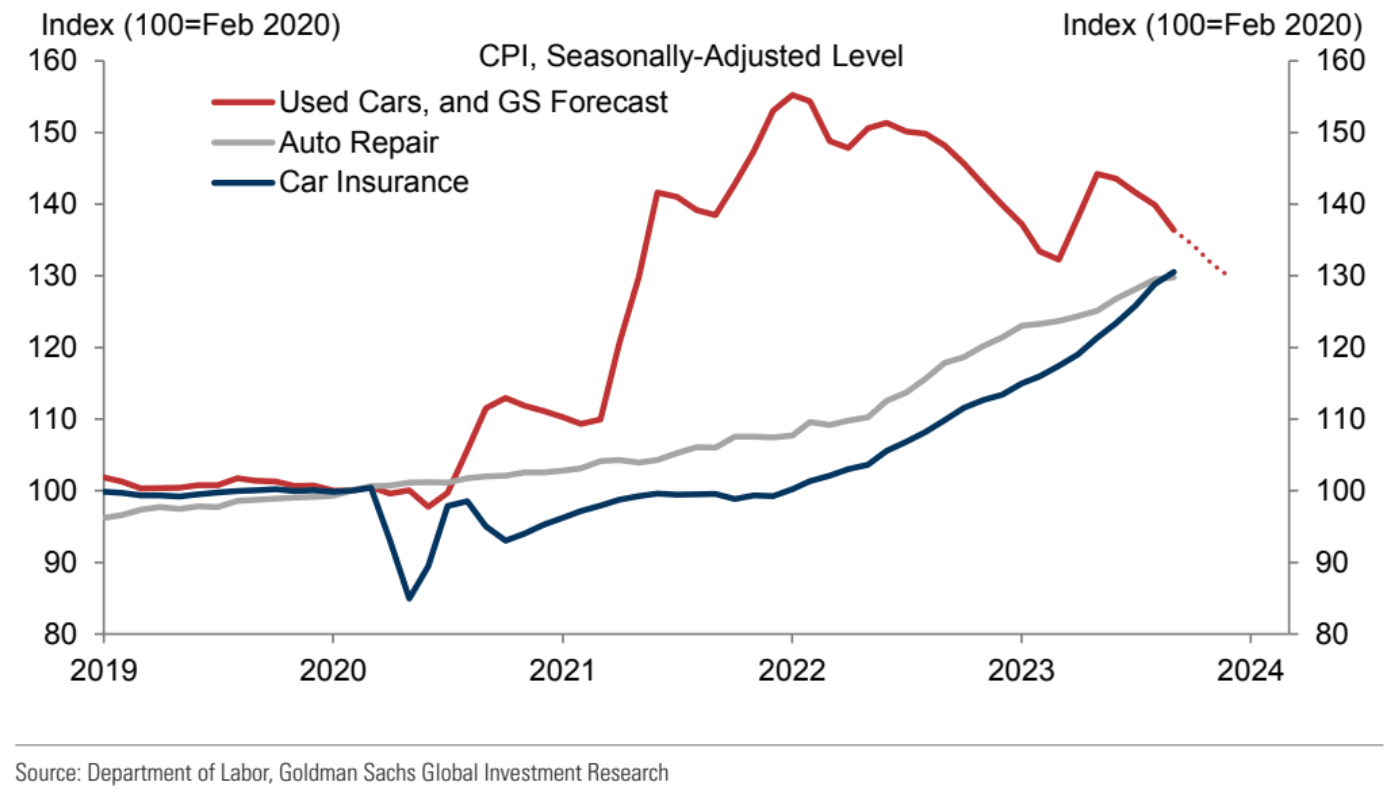

Goldman’s theory is that many consumer services categories experienced a kind of whiplash post-pandemic: rapidly increasing prices in response to higher labor and capital input costs, but level-setting to a new normal now. For example, in a recent note they wrote, “one example is car insurance, where pricing lagged the cost of repairing and replacing vehicles throughout 2021 but – following double-digit inflation in 2022 and 2023 – is now nearing a new and higher equilibrium price level. Reflecting this convergence, we expect the 1.5% monthly trend in the car insurance category year-to-date to slow to a monthly pace of 0.5-0.8% next year.”

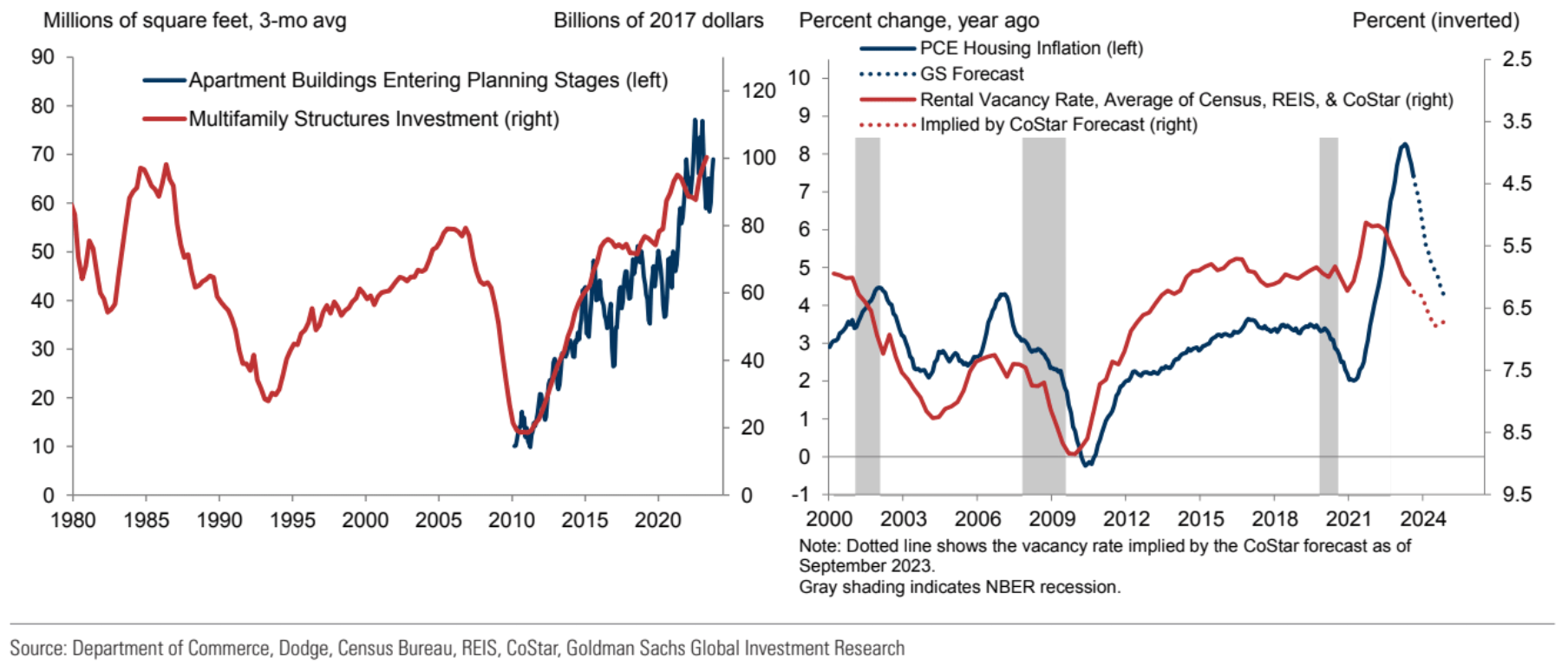

Additionally, Goldman expects a further decline in shelter inflation due to a “huge” increase in supply with 1.2 million apartments under construction and with the rental vacancy rate having already returned to pre-pandemic levels (therefore leading to landlords having less ability to squeeze out sizeable rent increases without having tenants move to alternative buildings).

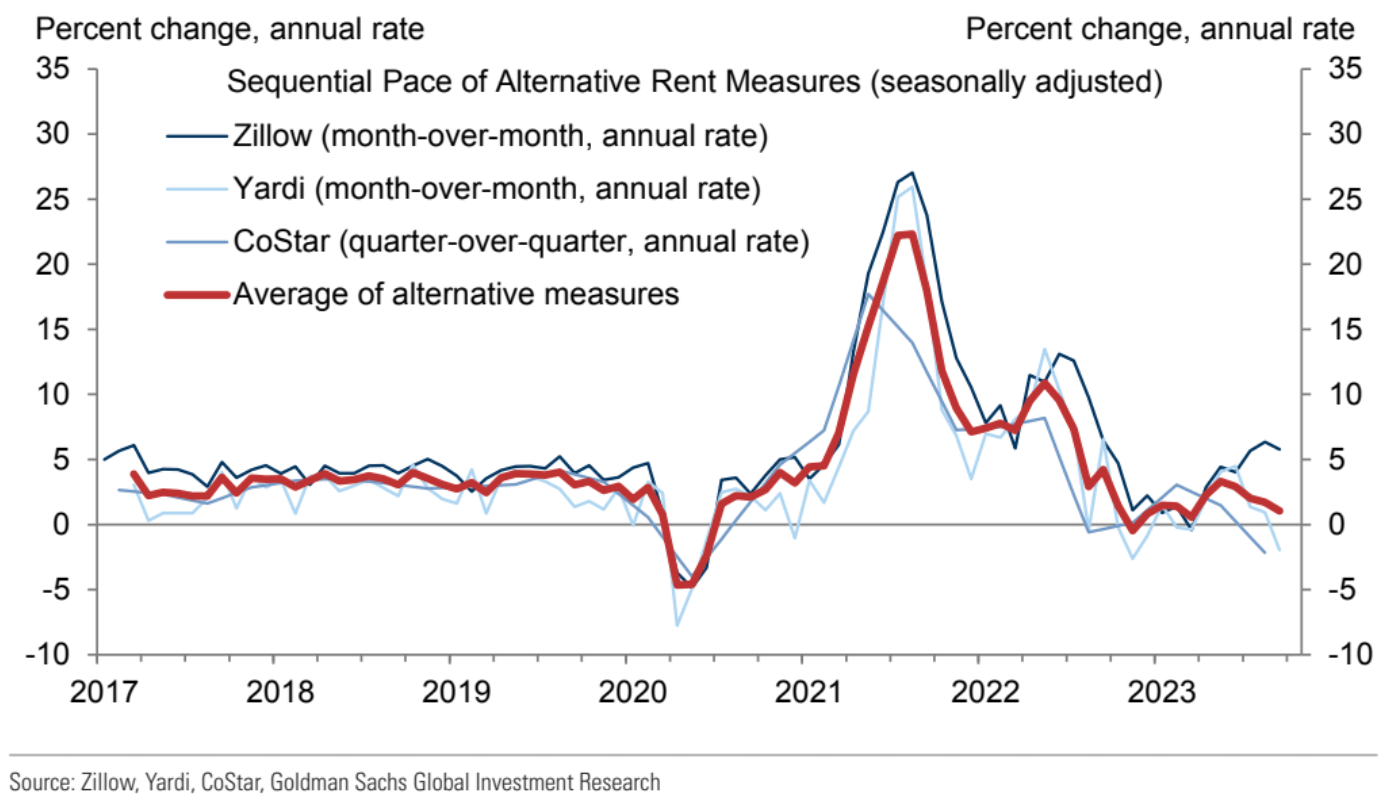

This can also be seen in real-time measures of rent inflation – since remember that shelter is a lagged component – that are showing around a 1-2% annualized increase and are (mostly) trending downwards.

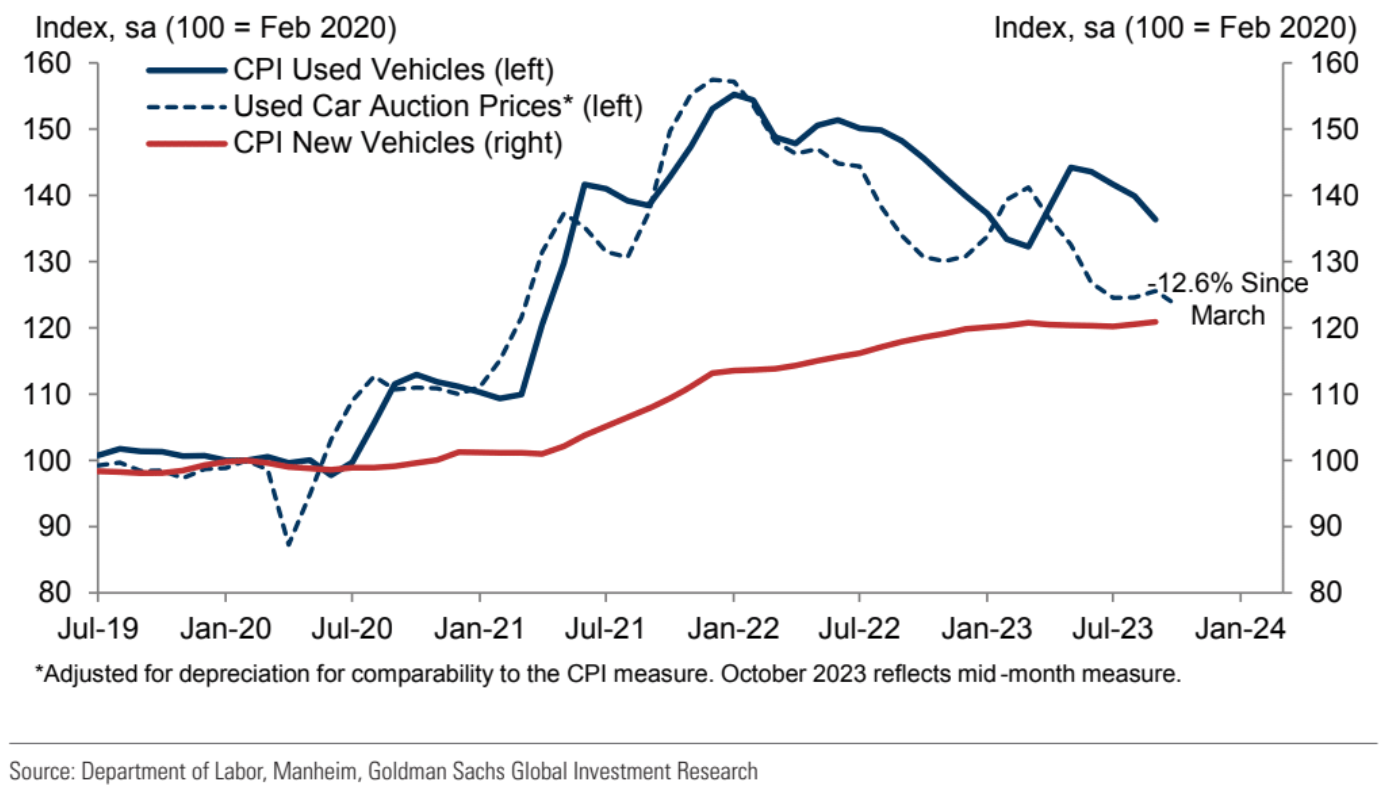

Finally, the other major category – one that dominated headlines through 2021 and 2022 – is used cars. Goldman was wrong in their prediction that we’d see used car prices falling to begin the year, thereby putting downward pressure on inflation, but they note that since March prices at wholesale auctions have fallen 13%.

Goldman believes there’s more room for used car pricing to fall – not only because of the rates backdrop making financing cost-prohibitive for some consumers, but also because auto production is beginning to gain steam once again combined with the fact that the UAW strike has had less of an impact than anticipated.

Conclusion

As I mentioned earlier, the current environment is one that’s a bit shakier with some thinking that the Q3 GDP print should be looked through and that significant weakness is around the corner, and others thinking that it’s a sign of higher growth coming in the next few quarters and the employment not cracking anytime soon.

Regardless, having growth of any kind in this environment should be welcome, as it’s not being replicated across many other economies: today, in Canada the flash GDP estimate was negative and in the Euro zone Q3 GDP came in negative too.

Keep in mind that the above are all market-based questions but be sure to also focus on behavioral questions too that are discussed in the longer sales and trading interview questions post and the massive sales and trading primer.