Mitsubishi UFJ Financial Group (MUFG) Sales and Trading Interview Questions

Last Updated:Each month Bank of America, Goldman, etc. conduct surveys to get a feel for how their clients are thinking about the dominate macro themes of the day. There’s a bit of selection bias at play with these surveys (since the busiest clients, whose views would be of most interest, are usually those least likely to respond) but they’re always interesting to read because they can confirm, or reject, how one thinks others are thinking about markets.

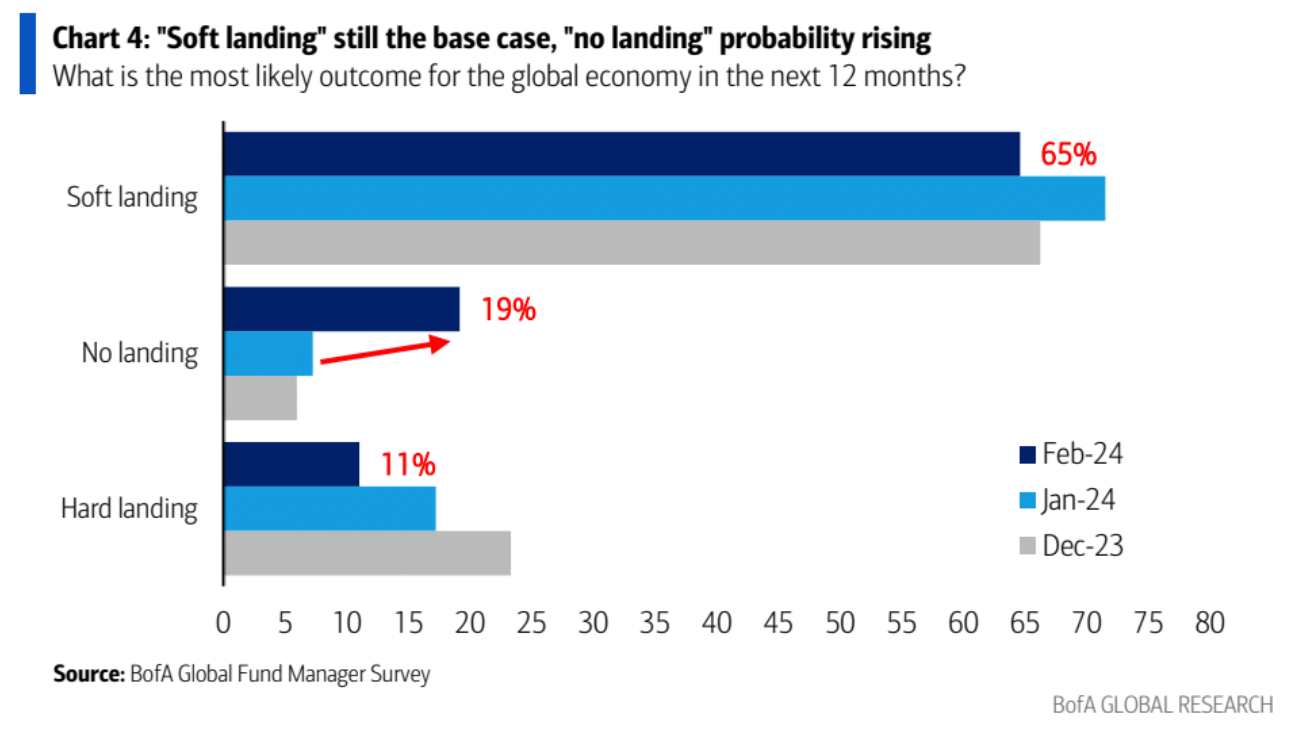

So it was no surprise that when Bank of America released the results from their January 2024 survey the vast majority of respondents were soft landers (those that believed that inflation would flutter down, labor markets would rebalance, and that growth would slow – but not enough to cause a recession, rather just enough to give the Fed the green light to lower rates to restimulate growth). Whereas a little over a year ago there was a roughly equal divide between soft- and hard-landers with a smaller fraction being no-landers (those that believed rates would need to remain higher for longer to bring inflation back down to target since growth would remain above trend and labor markets would remain too tight).

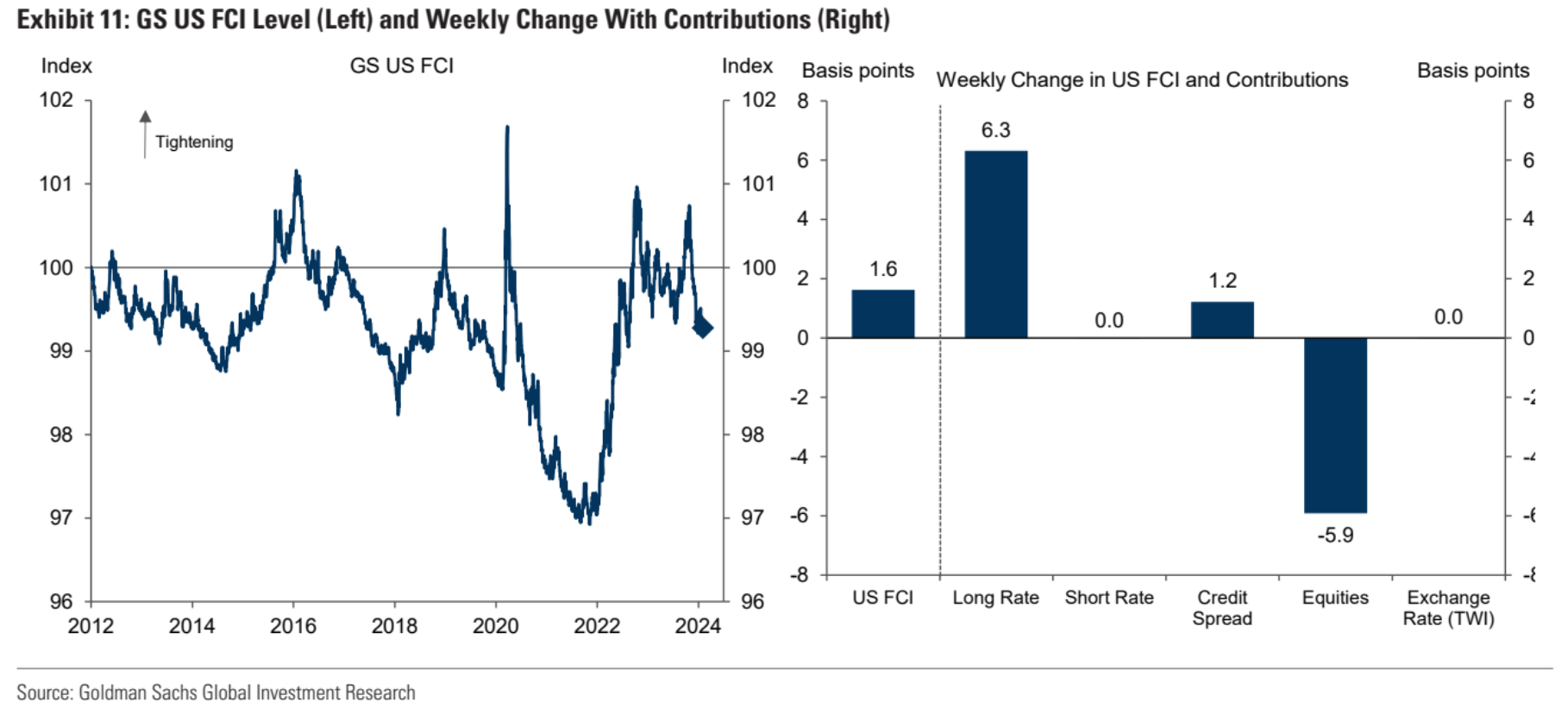

However, one rule of markets is that precisely when narratives become near unanimous is when those narratives begin to crack apart. In retrospect, there was little in January of 2024 that was inconsistent with a soft-landing narrative. Core CPI / PCE kept plummeting down, the labor market softened but not enough to raise alarm bells, and financial markets continued to rally (both in fixed income and in equities). Plus, on top of this there was a continued easing of financial conditions over the last few months.

But there is a fundamental tension here: if GDP continues to surprise to the upside too much, labor markets remain too tight, wage growth doesn’t fall too much, and financial conditions ease too much then there’s little impetus for inflation to fall back to and stabilize around target. There’s no free lunch – it can’t be the best of all worlds. Instead, one would expect that under these conditions inflation would begin to rise again (even though it has been on a steady slide) and stabilize at some level a bit above target. And, as a result, the Fed would have to retrench and forgo the rate cuts that markets have been anticipating and salivating over for months.

Because, as some have begun to wonder, maybe the real transient aspect of inflation was not its rise through 2021, but its fall through 2023. Maybe it was idiosyncratic, one-off factors that lead to the sharp decline in inflation over the last twelve months (i.e., China exporting deflation, oil prices falling, etc.). Maybe, as some thought through 2022, inflation has become more embedded in the economy and that there are structural drivers of inflation that’ll make it difficult to get the inflationary genie back into the bottle (i.e., it’ll take higher rates for longer, or an actual recession, to see inflation recede back to the Fed’s target and stay there). Maybe a no-landing situation, which has always been a minority view, is actually the most plausible one.

While it’s always a bad idea to extrapolate from one datapoint, on Feb 13 Core CPI came out and it landed with a thud. The average estimate was 0.28% MoM and the median estimate was 0.30% MoM. But it came in at 0.39% MoM which was near the top of survey expectations and the highest MoM print in nine months (to their credit, GS anticipated a print of 0.38% and their out-of-consensus call was the closest).

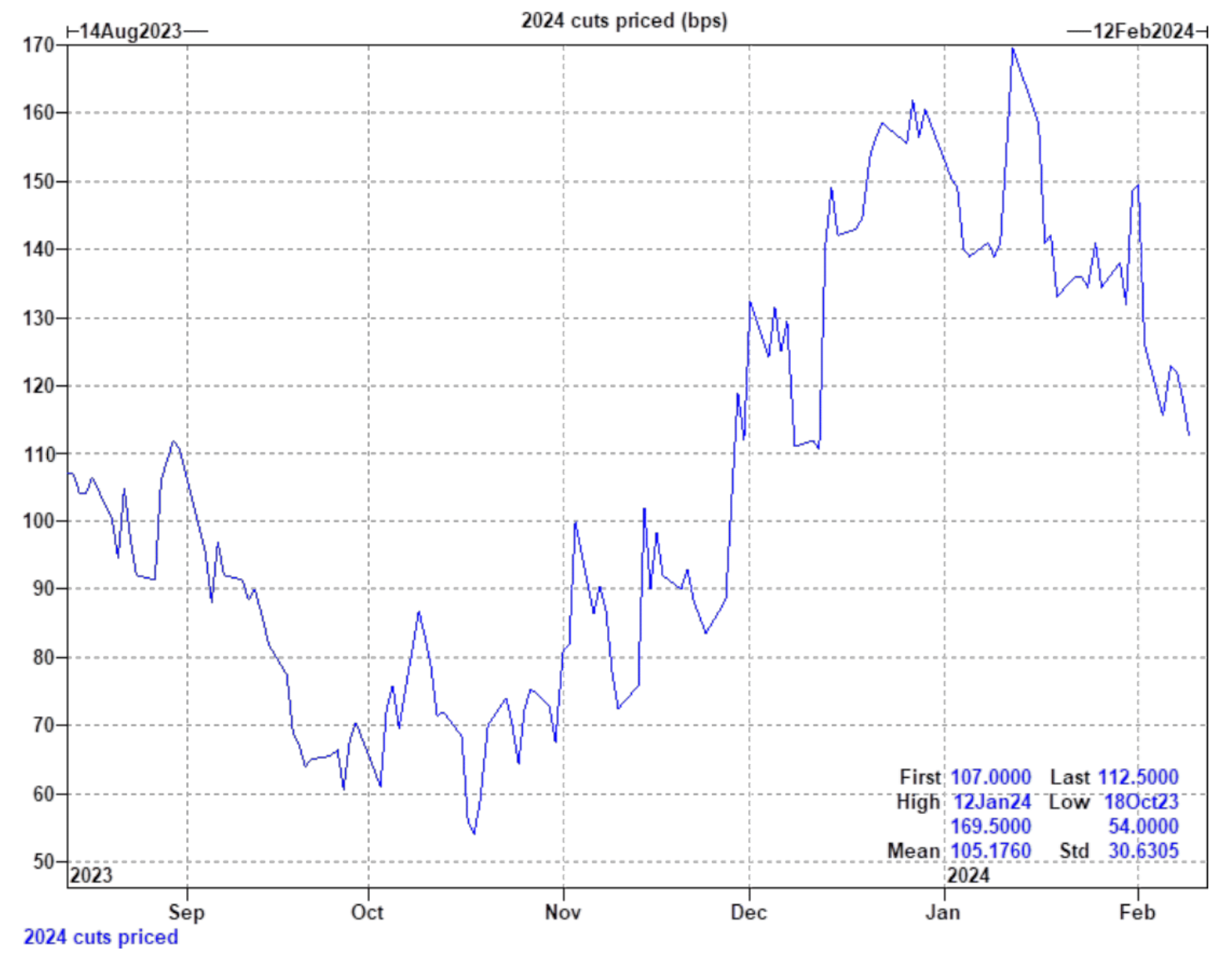

In the last few months it's often seemed as though everyone has been in a race to one-up each other with their bets on how many rate cuts will happen in 2024. However, the narrative has begun to shift back to wondering when the Fed will feel comfortable cutting rates to begin with.

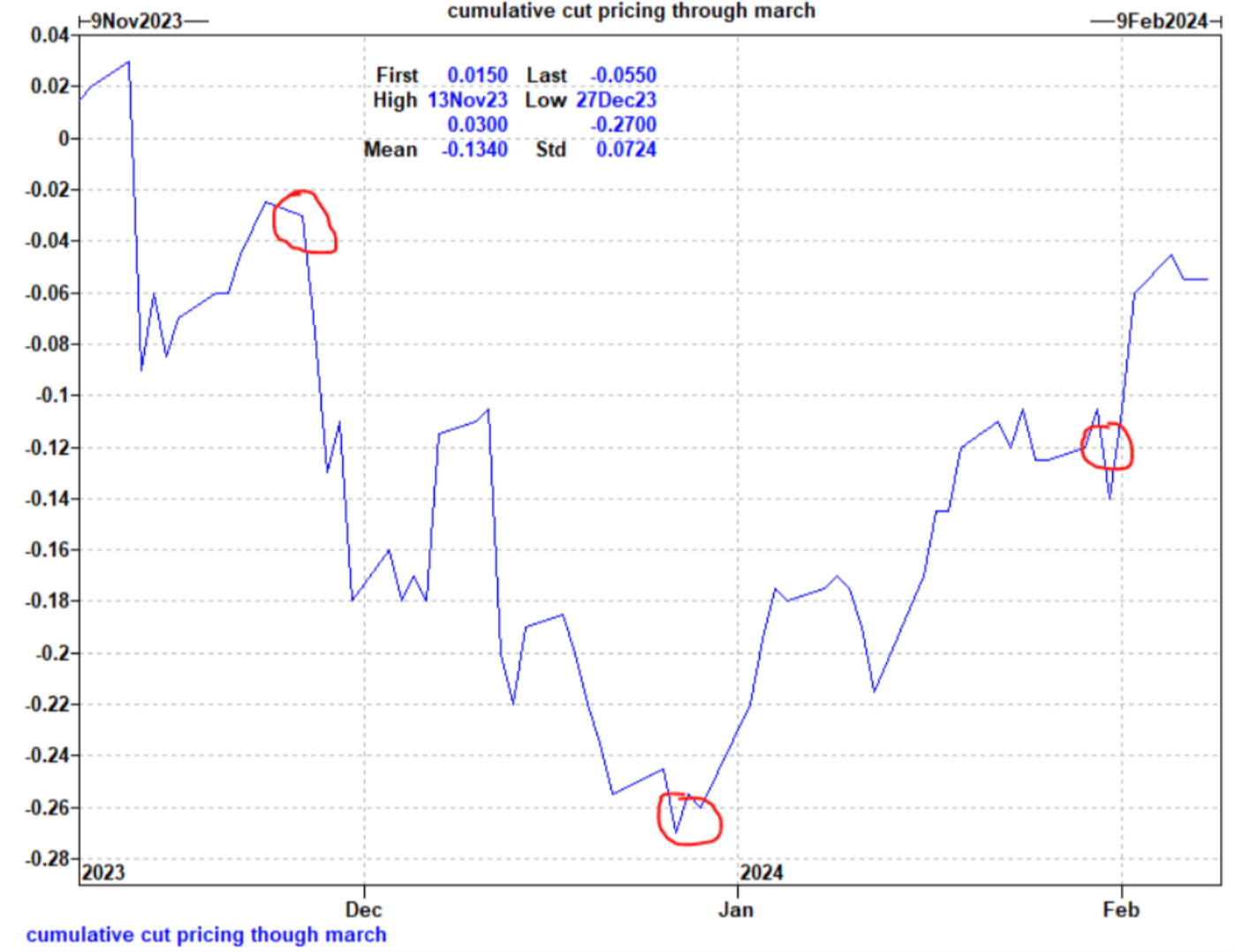

Because cutting rates, only to then hike again later, would be such a severe blow to the Fed’s credibility that most agree they’ll only begin cutting when the path towards 2% inflation is all but assured. The issue is that most thought we were pretty much at the end of that path right now but this recent print has poured some cold water over that belief. Therefore, some market participants are now wondering if the Fed will be so spooked by this print as to push off rate cuts beyond even May ‘24, never mind March ’24, even if future core CPI prints are more inline with what we've seen in prior months (there was a time, only a few weeks ago, when the Fed cutting by 25bps in March was a consensus view – now, for obvious reasons, it’s been almost completely priced out).

MUFG Sales and Trading Interview Questions

MUFG is one of the few banks that I haven’t written about over the past few years because their sales and trading business is structured in a somewhat unique way relative to others. This is due to the fact that in 2008 they invested $9bn into Morgan Stanley in return for a 20% stake. And, as a result, outside of Japan and now within Japan they’ve merged some of their sales and trading business with MS (since MS has always been a strong player in sales and trading and it makes sense to leverage the obvious synergies where applicable).

However, MUFG does still hire independently in most of its global offices, and while it’s S&T franchise has had ups and downs they’ve remained committed to growing it and integrating more with MS where it makes sense for both from a market share perspective.

- Over the last month rates markets have priced in between 125bps and 175bps of rate cuts through 2024. How confident are you that we’ll have an amount of rate cuts that fall within that range?

- There has been a number of geo-political shocks over the last few months. However, oil remains quite range-bound. Why do you think this is?

- When do you think the Bank of Japan will end its Negative Interest Rates Policy?

Over the last month rates markets have priced in between 125bps and 175bps of rate cuts through 2024. How confident are you that we’ll have an amount of rate cuts that fall within that range?

As mentioned above, through December and into January bets on rate cuts reached an almost fever pitch. It was a remarkable turn of events since one only had to look back to mid-October to see under 60bps of rate cuts priced in for 2024. Back then it was still the belief of market participants that the Fed would be reluctant to move toward rate cuts unless there was material economic deterioration or inflation fluttered back to around target. In other words, they would rather be late than early on rate cuts because of the reputational damage that would result from prematurely cutting only to have to backtrack if inflationary pressures reemerge.

However, this all changed in late November. And if one were to put a precise date on when sentiment shifted and aggressive rate cuts began to be priced in, it’d be November 28 when the Fed’s Waller gave a speech in which he said, “If you see this [low] inflation continuing for several more months, I don’t know how long that might be – three months, four months, five months – you could then start lowering the policy rate because inflation’s lower”.

This was viewed by markets as the Fed giving the signal that they were confident that inflation was moving toward target and were prepared to lower rates in the near future to avoid rates being overly restrictive (in real terms) since the lynchpin of a successful soft landing is gently easing rates while inflation declines and growth falls so as to slightly stimulate the economy and avoid it tipping into recession.

This sentiment shift, reinforced through the December FOMC and Powell’s somewhat dovish comments, resulted in not only significant rate cuts being priced in for 2024, but rate cuts being priced in quite soon (for nearly a month the market was pricing in that it was more likely than not that we'd have a rate cut of 25bps at the March meeting).

However, the market, as it’s done several times over the last few years, appears to have gotten firmly ahead of itself: through Q4 2023 and into 2024 we’ve had stronger than expected GDP growth, with the Atlanta Fed projecting 3.4% growth this quarter; we've had unemployment of 3.7% with wage inflation still at levels that are inconsistent with inflation returning to target; and we've had MoM CPI for Jan that was, as discussed above, well above expectations (although some like GS think that the Jan CPI is an aberration due to seasonal factors and that it’ll return to its downward slide in months to come).

Against this backdrop, it’s hard to imagine 125bps of cuts this year, never mind 175bps of cuts, because there are only so many FOMC meetings in a year and there’s no chance that the Fed will cut by 50bps or 75bps in a single meeting unless it’s against a recessionary backdrop. So insofar as the March and (maybe) May meetings are off the table, that doesn’t leave much time in the rest of 2024 to cut unless the Fed will be cutting by more than 25bps (i.e., 50bps or 75bps) at each meeting. But signs of economic weakness that would warrant large cuts (perhaps any cuts!) aren’t showing up in backwards looking data or forward looking data such as the Atlanta Fed’s GDP tracker or analyst estimates.

Put another way: it’s difficult to see the economic need for the Fed to cut rates in the short term, and so they’ll likely be reticent to move too proactively to cut due to the fear of having to reverse themselves. This is something that the Fed has been saying for months now and that has shown up in their own dot plots which show only three (not five to seven!) rate cuts through 2024. But the market didn’t believe the Fed, decided to front run them by pricing in up to 175bps of cuts, and has now had to reel back pricing against a hotter economic backdrop than the market anticipated.

As Goldman’s Brown said in a recent desk note, “The combination of less dovish Fed Speak and stronger data has largely allowed March meeting to be priced out, and as such, the distribution of outcomes for rate cuts this year should shift as well. In our view, 4 or 5 cuts this year is the base case (in line with market pricing of 114 bps; somewhat more than the Fed’s dot plot, which projected 3).Given the left tail of cuts is larger than the right tail, we think the market should continue to price closer to 5 cuts in the near future – we think pricing 7 cuts again is very unlikely, and the new range is likely 3 to 6.”

There has been a number of geo-political shocks over the last few months. However, oil remains quite range-bound. Why do you think this is?

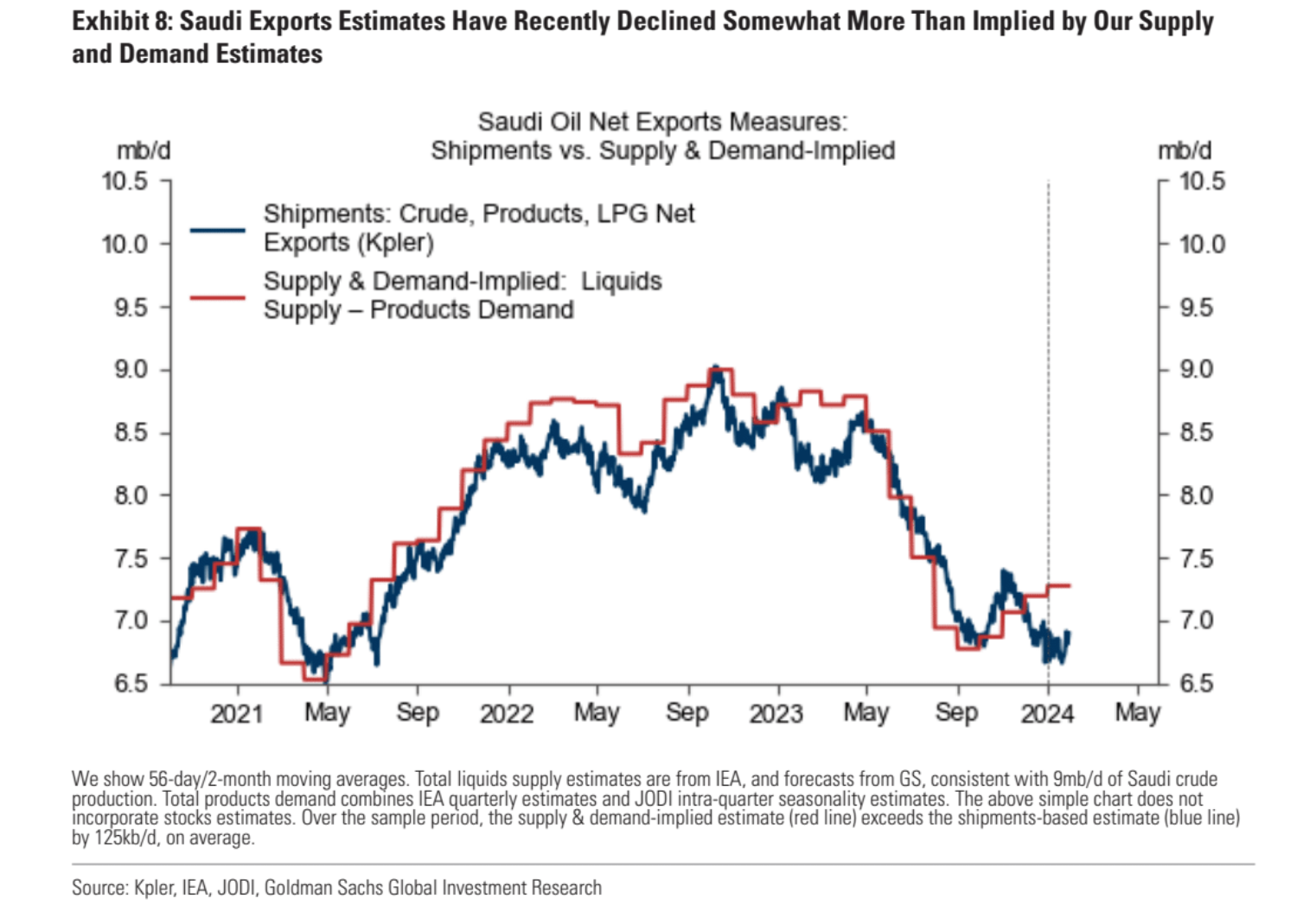

Like with all commodities, it all comes back to supply and demand. And despite all the geo-political issues of the past few months there hasn’t been a significant supply disruption. As Xiao, Global Co-Head of Commodities Trading at GS, said in a recent desk note: “We haven’t lost a single drop of oil supply yet, and we need several tiers of escalation to face supply drop issues in both middle east and Russia/Ukraine front. I expect oil price to remain range bound for 1h24 particularly given seasonal weak demand and downside macro risk to offset geo-political risk premiums; then the oil market has the upside potential to 90 dollars in Q3”.

After Saudi Arabia shouldered the burden of supply cuts to buoy prices through 2023, there appears to be a successful balance achieved whereby large spare capacity, matched with discipline around the production cap, should allow OPEC to keep oil range bound between $70-90 barring a significant change (i.e., if demand increases, there’s the capacity to increase production, if there’s a decline in demand, there’s the discipline to cut production further to keep prices within the $70-90/bbl range).

In the view of GS there are three factors that could lead to upside beyond the $70-90/bbl range. First, a change in Saudi strategy (i.e., decreasing production further below their current levels). Second, a geopolitical shock that goes above and beyond a Red Sea disruption which GS estimates to be at most a $3-4/bbl impact if there’s full disruption of the route. Third, persistent global economic growth well above expectations (i.e., a strong China rebound).

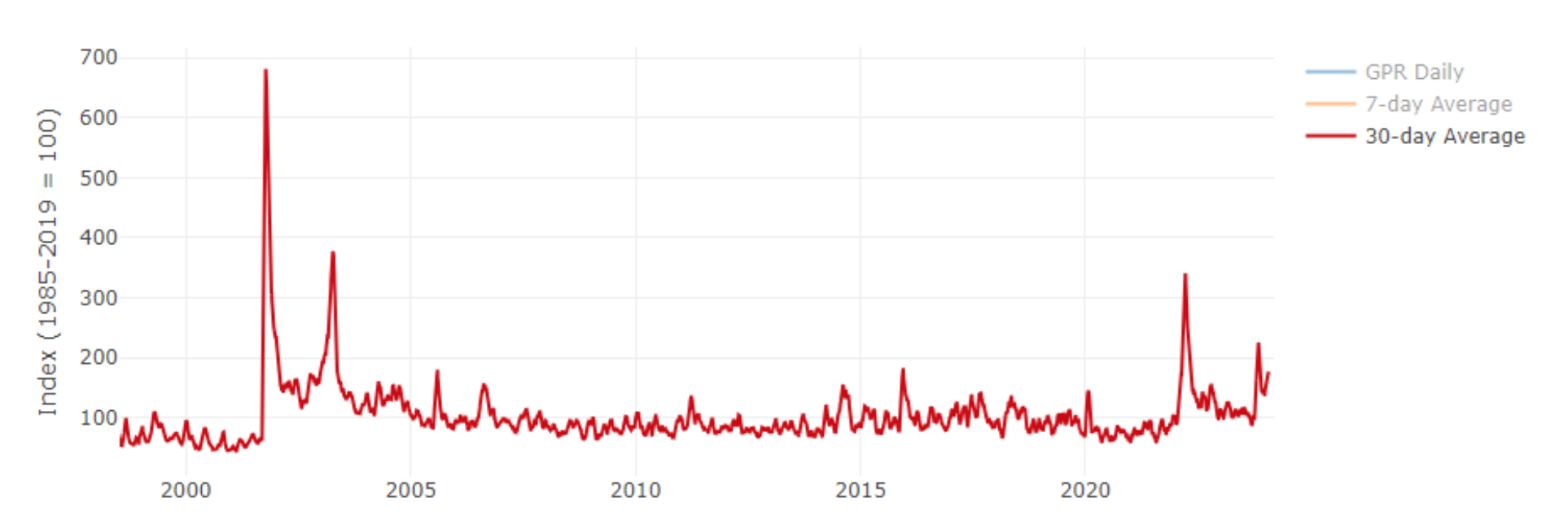

Here’s where Goldman’s Geopolitical Risk Index stands today – at elevated levels, but still well below the short spike from the initiation of the Russia/Ukraine conflict.

When do you think the Bank of Japan will end its Negative Interest Rates Policy?

Even if you’re interviewing for a role at MUFG outside of Japan, it’s worth having an idea for the major themes there – and there’s no bigger theme than when the BoJ’s NIRP will end. Right now, the consensus is that there’s an outside shot the policy change could take place in March but most believe it'll take place in April. Then, with NIRP relegated to the dustbin of history – until it’s invariably brought back in a few years – the market’s attention will shift squarely to if additional hikes will take place this year or not.

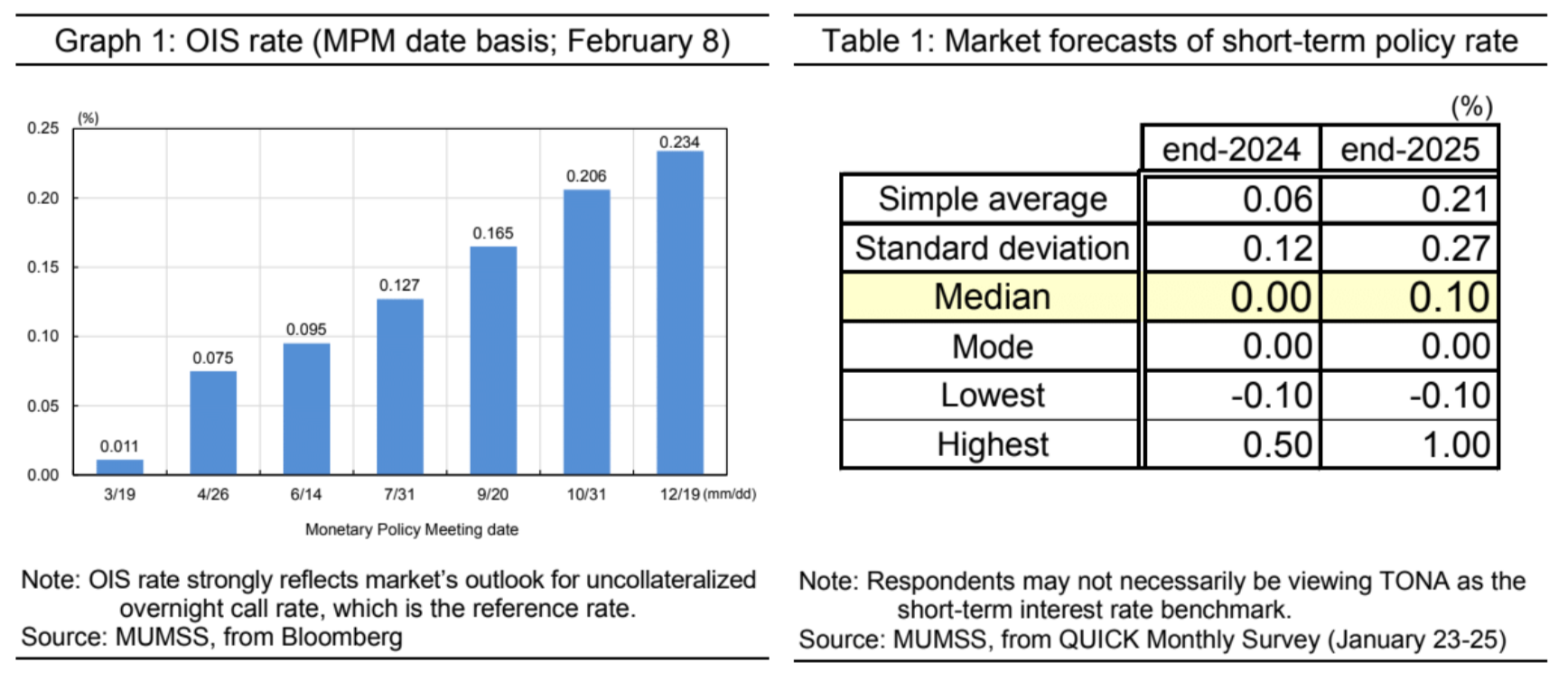

As is often the case in Japan, there’s a difference in market sentiment between foreign and domestic investors. The overnight index swap (OIS) rate suggests there should be an additional 25bps of hikes within the year (the OIS market is more heavily traded by foreign investors so many use it as a gauge of foreign investor sentiment). On the flip side, domestic investors do not appear to anticipate an additional rate hike in 2024. Instead, they anticipate only 10bps worth of hikes by the end of 2025 (the table below is from a MUFG survey of domestic JGB market participants).

Based on the recent remarks from BoJ Governor Kazuo Ueda on Jan 23, it certainly sounds like domestic investors have their fingers more firmly on the pulse of the trajectory of rate hikes. Because in those remarks the Governor said, “Even if we were to end negative rates, monetary conditions will likely remain very accommodative for the time being”. This was echoed by the BoJ's Deputy Governor Shinichi Uchida who said, “…even if the Bank were to terminate the negative interest rate policy, it is hard to imagine a path in which it would then keep raising the interest rate rapidly.”

It can seem a bit absurd to think that one 25bps hike this year would be considered raising rates rapidly – but in the context of Japan, where the last few decades have been defined by zero or negative interest rates, it is. Further, Japan’s recent growth has been lackluster (to put it mildly) and they’ve just entered a technical recession after Q4 2023 GDP fell 0.4% on an annualized basis after it was expected to expand 1.1% on an annualized basis. So while the BoJ doesn't seem too fazed by the GDP print, it’s unlikely that we’ll see “rapid” rate hikes into the teeth of a recession (even if it ends up being modest as the BoJ is expecting).

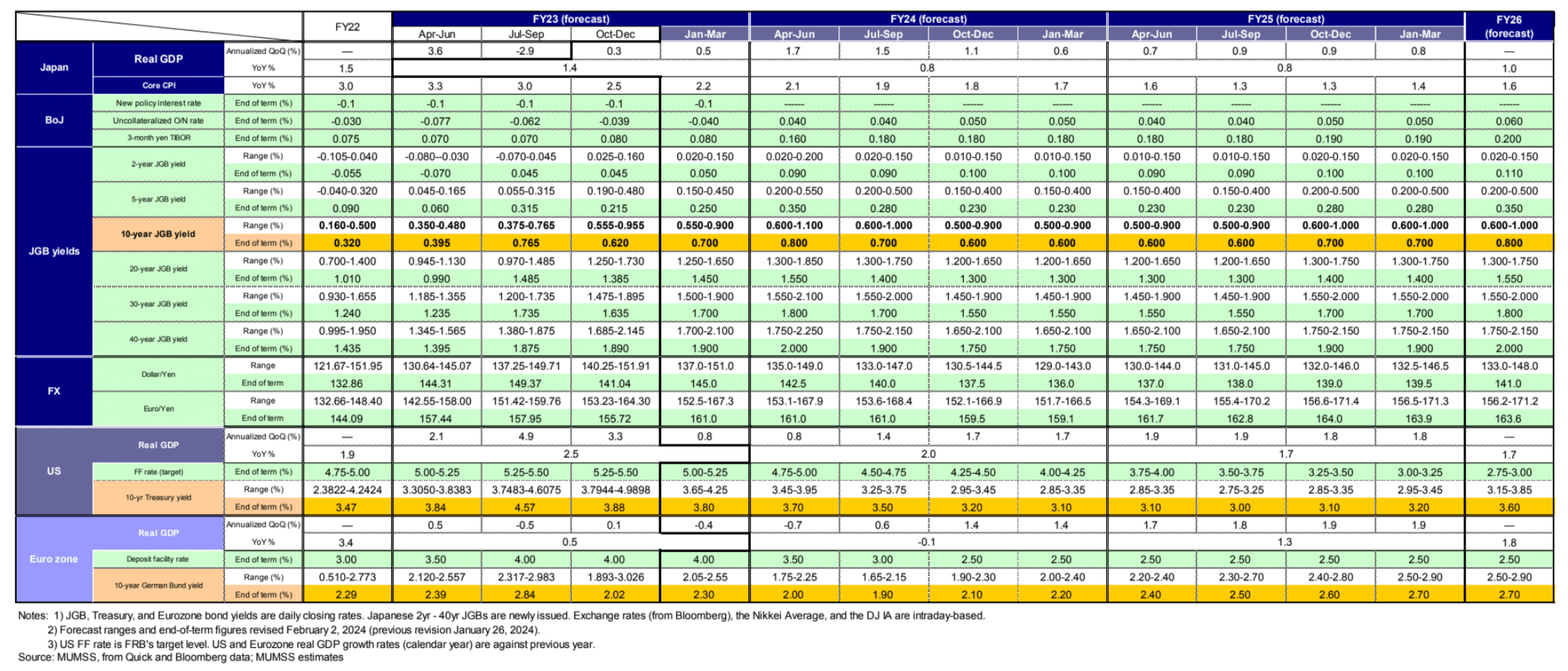

Here are some of MUFG's current forecasts (both economic and financial) for the next few years...

Conclusion

As I mentioned earlier, MUFG is a bit unique. It’s an extremely strong player within Japan and has both expanded and contracted its global footprint over the last decade. However, due to its well-timed investment in Morgan Stanley, the two have become more and more intertwined over the years – or perhaps I should say MUFG has integrated into the MS platform where synergies exist – and all recent signs are that MUFG is seeking to emphasize and expand out its S&T franchise in this unique way.

If you’re currently interviewing at MUFG – even if it’s for a role outside Japan – it’s not a bad idea to spend a bit of time reading about JGB, JPY, etc. themes in case you're asked. Beyond that, the interview should be a mix of classic sales and trading interview questions (i.e., market-based questions, as illustrated above, sprinkled in with some behavioral questions and, if it’s a desk specific role, some technical questions on the asset class the desk focuses on).