Crédit Agricole Global Markets Interview Questions

Last Updated:As we talked about a few months ago, Goldman, MS, Bank of America, etc. will do client surveys around once a month or so to try to get a pulse for how clients are thinking about the broad macro themes of the moment. A few days ago BofA dropped their latest survey, and it captures nicely the shift (or perhaps lurch) in sentiment that’s occurred since the start of the year.

It was around this time two years ago that a majority of market participants were betting on a hard landing scenario: that the Fed’s rapid rate hike cycle would “break” something and that a recession would likely occur within the next year – bringing down inflation, sure, but at a steep cost. There were even some, like Bloomberg economics, that assigned a 100% probability to a recession occuring sometime in 2023 (that’s why you should never assign a 100% probability to anything!).

But in 2023 as growth remained resilient, the labor market rebalanced, wage inflation began to fall, and a seemingly immaculate drop in CPI occurred, market participants grew a bit wobbly on the hard landing scenario. And gradually the soft landing scenario went from being an aspiration to becoming the consensus view on what would occur – that, somehow, we’d end up having growth be a bit below potential over the next year or two while inflation would flutter back to target thus allowing the Fed to begin normalizing rates down to some neutral level (that would be consistent with full employment and inflation staying anchored at around 2%).

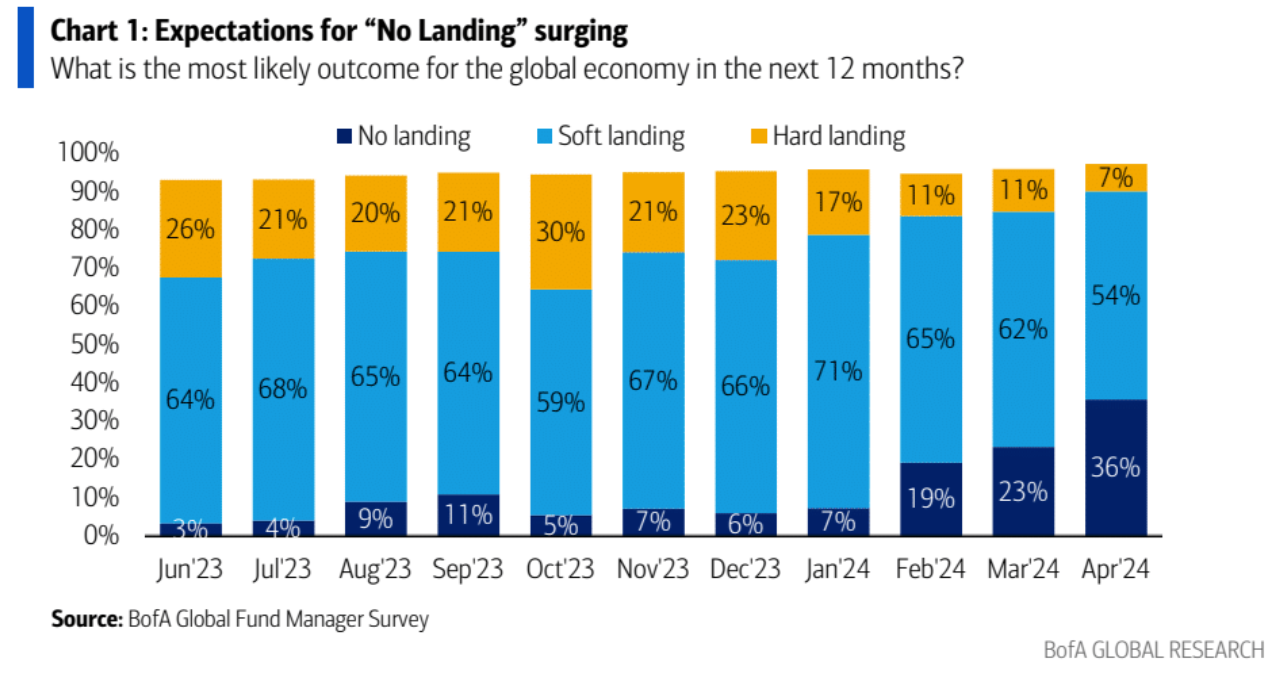

In markets it’s difficult for anyone to agree on anything – so it was remarkable that in BofA’s January 2024 client survey that asked market participants what the most likely outcome for the economy would be (both globally and in the US alone) a super majority thought a soft landing would take place.

However, over the last few months the tide has begun to turn once more: this time to a non-trivial number of market participants believing that a no landing scenario, where both growth and inflation stay elevated, is the most probable outcome (this is something that only a few percent of market participants thought possible this time last year).

Just as the consensus shift from a hard landing to a soft landing unleashed a significant amount of volatility as every asset class readjusted to the new consensus, so too will the shift from a soft landing to a no landing – but it’s not clear that this shift will occur quite yet (we’ll need at least a few months more of hot growth and inflation prints first).

However, if the shift does occur then 2024 will have some raucous price action and the revenues of S&T divisions across the street will be a bright spot for banks when they report earnings (the surprising volatility of Q1 2024, especially in fixed income, as yields began their march back up has already led to stronger than expected strength in S&T revenues at most banks).

Crédit Agricole Global Markets Interview Questions

While Crédit Agricole is smaller than its peers, it was one of the few banks over the last few quarters of 2023 that was been able to buck the trend of S&T revenue declines (remember that S&T revenue is largely a function of volatility – so as markets became a bit quieter in late-2023 compared to late-2022 most saw softer revenue on a year-over-year basis).

So since Crédit Agricole is one of the few banks with a proper S&T (global markets) program that I haven’t written a post on, I’ll keep to my more recent trend that everyone seems to enjoy and talk through a few market-based questions based on where markets stand now...

- Given the recent raft of economic data, how many rate cuts do you think the Fed will do this year?

- Do you think we’ll have policy divergence between the Fed, ECB, and BoE? If so, when do you think that divergence will begin.

- If a no landing scenario in the US becomes the consensus view would you go more overweight or underweight cash, treasuries, and equities?

Given the recent raft of economic data, how many rate cuts do you think the Fed will do this year?

While some tried to dismiss the hotter-than-expected CPI prints of January and February (including the FOMC!), the March print was so above expectations (above the estimates of almost everyone) that the probability of a June cut (which at one time was more likely than not) was mostly taken off the board.

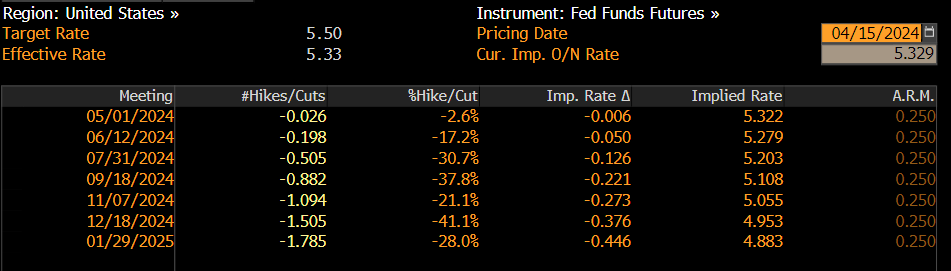

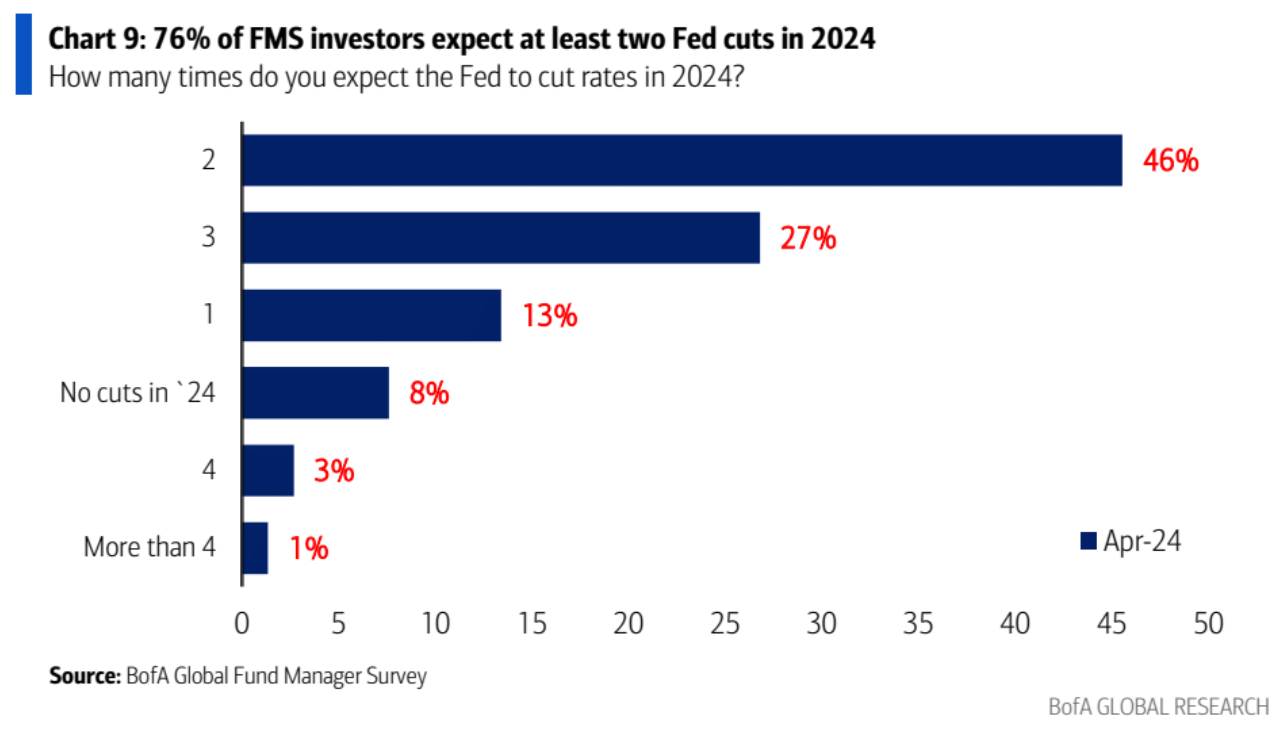

And when combined with hotter than expected retail sales, Q2 GDP estimates being revised up, a head-scratching 303k increase in non-farm payrolls, and recent comments from Powell on how three straight hotter-than-expected prints have informed his thinking on when rates will normalize the market is now pricing in around two cuts this year and there’s a (small) minority of market participants who think there’s a reasonable probability of no cuts this year and an even smaller minority who assign a non-zero probability of the Fed’s next move being up rather than down. It's been a remarkable turn of events since it was only four months ago that around 140bps of cuts were priced in for 2024.

The Fed has made it clear that they aren’t looking for inflation to fall to target that quickly (just look at their summary of economic projections, by their own forecasts core PCE will be closer to 3% than 2% to close the year) but they want to see a viable pathway to target before they begin normalizing rates.

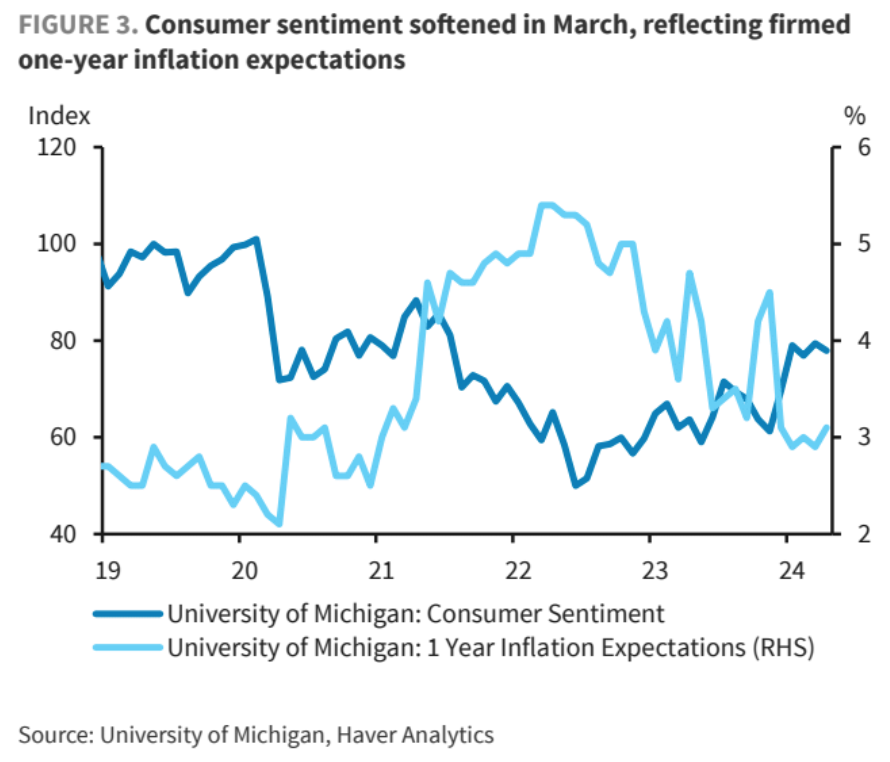

Because to do an about face and raise rates after having cut them would be a severe blow to their credibility, and the Fed knows that if inflation expectations (that have inched up in recent months) become unanchored then it'll make the job of tamping down inflationary pressures even harder.

While right now the market is pricing in around two cuts for 2024 – down from 2.5 before last week’s CPI print and down 4.5 from where we were at the start of the year – as Brandon Brown of GS said in a recent desk note, “…we think the long tail of large cuts has grown meaningfully (even May meeting pricing in 1.5bps of risk premium) while the central case has likely shifted from 3 cuts to 1 or 2. No cuts this year is certainly possible if data continues to print as it has through Q1, although not our base case.”

The long tail refers to the fact that even though the data we’ve been getting has been stronger than almost anyone expected, this has been against a backdrop of continued geo-political risks building up. Plus, most still agree that rates are at least somewhat restrictive at these levels and the longer the Fed is forced into holding rates here (because the data gives them no excuse to cut) the higher the likelihood is that an event comes along that forces a quick succession of cuts or a larger than 25bps cut in one meeting.

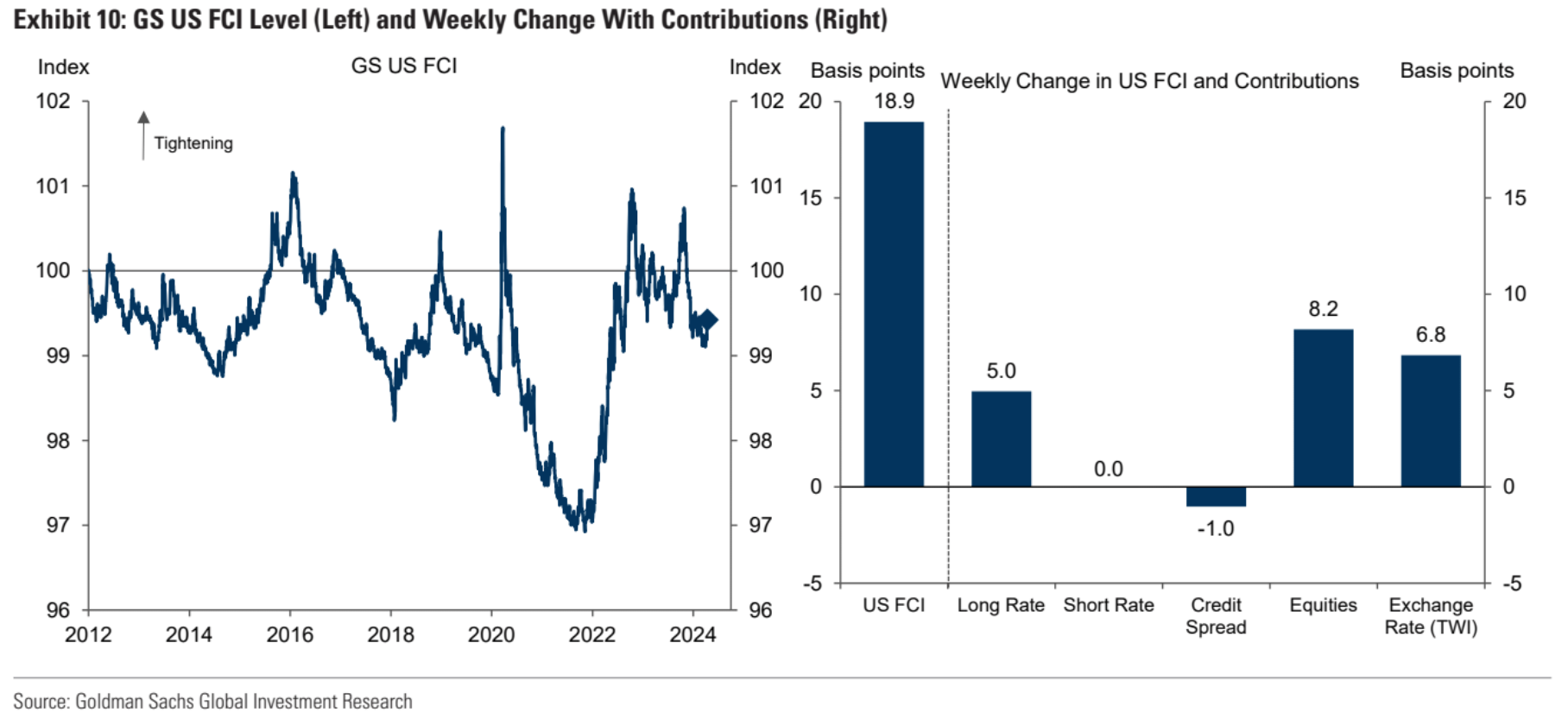

But, on the other hand, it’s hard to look at financial conditions right now and say that they’re tight – even if Fed Funds happen to be 5.5%. When the Fed was worried about rates being too restrictive after the regional bank “crisis” of 2023, the market loosened financial conditions through yields out the curve plummeting and equities rallying – it was the market doing the Fed’s job for them.

However, now that we have relatively loose financial conditions and the Fed is staring at a potential re-acceleration of inflation, it’s probably wishing that the market would do its job for them and tighten financial conditions a bit to avoid the Fed needing to hike again (one way to do that is for Fed members to start jawboning to talk the market down, like Powell famously did at Jackson Hole a few years ago, but we haven't quite seen that yet...).

Do you think we’ll have policy divergence between the Fed, ECB, and BoE? If so, when do you think that divergence will begin.

The Fed found itself in a bit of an awkward situation last week. In the FOMC meetings minutes that were released shortly before March’s CPI print the FOMC participants suggested that the hotter-than-expected Jan and Feb CPI and PCE prints were mere aberrations on inflation’s glide path downwards (informed by seasonal issues or one-off factors, not indicative of a meaningful turn up in inflation).

But then came March CPI that complicated matters. It wasn’t just that core CPI came in at 0.36%, it was that looking a bit under the hood supercore inflation (core services excluding housing) continued to pick up steam and is now running at a 6-7% annualized rate.

And this is a measure that Powell has frequently mentioned before since sticky services inflation at significantly elevated levels (i.e., probably anything north of 5%) would require significant disinflation in core goods or shelter to keep inflation around target which may occur temporarily (as has been the case in recent months) but can’t be relied on for years to come. In other words, if supercore is still high and goods deflation returns to more normalized (positive) levels then all of a sudden we’re back to having inflation running at levels well above target. So the re-acceleration of supercore is not a welcome development.

The realization by markets that the Fed won’t have much of an excuse to cut in June led to rate cuts (once again) being pushed out further. GS believes that the Fed will move in July (whereas before CPI they had them moving in June) whereas the broader market thinks the September meeting is now the most likely time that an initial cut could occur (assuming that core CPI / core PCE slow to a level that’s more in the Fed's comfort range – the number to look out for is probably around 0.20% mom give or take).

However, across the pond those betting on rate cuts have been rewarded. The ECB has benefited from largely cooperative inflation data, and changed their guidance from stating that rates need to be maintained at current levels until a durable decline in inflation has occurred to now stating that if inflation “…is converging to target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.” Which is a central bank’s way of saying, “As long as nothing too crazy happens over the next few months, we’re on track to begin the rate cut cycle.” Because of this, the market is pricing in the ECB beginning their rate cut cycle in June, so that’s when policy divergence with the Fed will begin.

Likewise, the BoE is also anticipated to begin their rate cut cycle in June based largely on the backdrop of economic sluggishness (as is true in the Euro area too) that exists there and which is in stark contrast to the consistently surprising growth and labor market data coming out of the US.

To be fair, growth in the UK has picked up a touch in recent months, and some like Barclays have revised up their 2024 GDP forecast to +0.4% yoy as opposed to +0.1% (although neither of those numbers are much to write home about!).

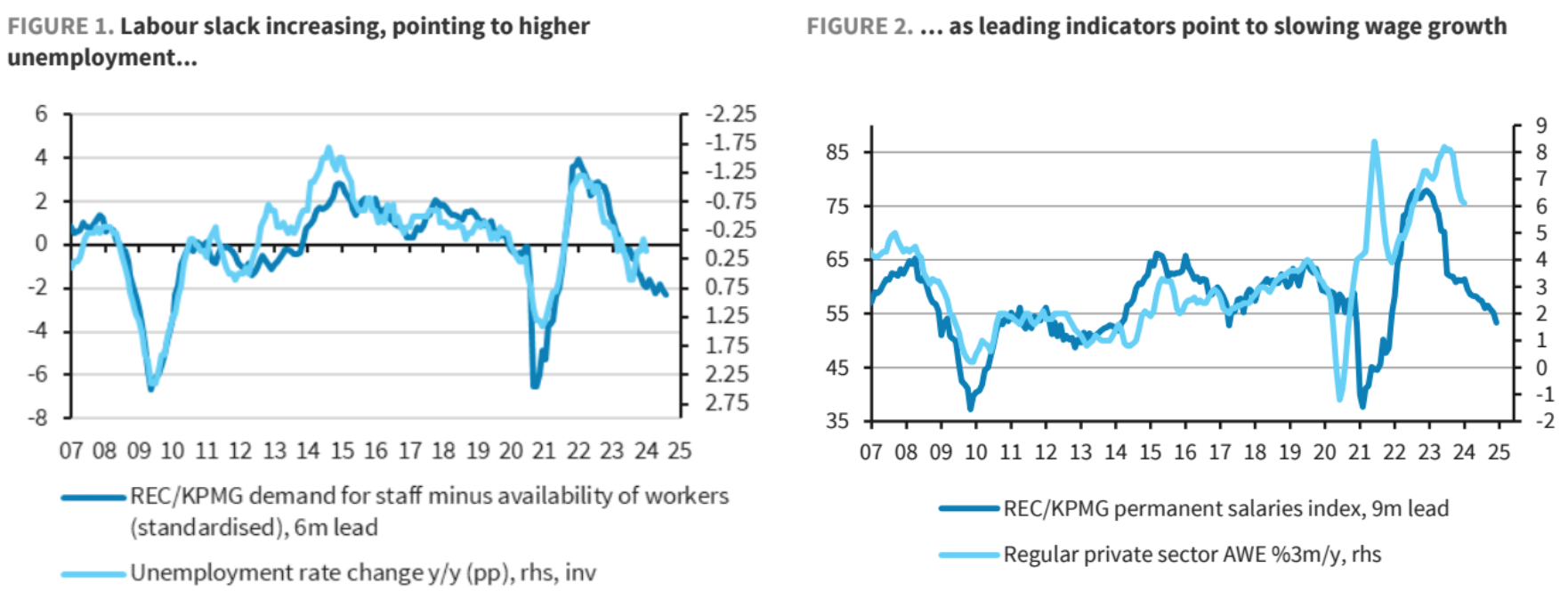

However, this sluggish growth has been needed to rebalance the labor market and bring down stubbornly high wage inflation figures that haven't come down as readily as they have in the US (which is partly why inflation has been stickier in the UK even though growth has been so lukewarm relative to the US).

As I've said before, no one likes to hear that wage inflation needs to normalize in order for overall inflation to do so - and Governor Bailey has got himself in hot water for saying the quiet part out loud on wage inflation. But them's the breaks.

With that said, in the UK we did see March core CPI inflation come in at 4.2% yoy, a smudge above consensus, with core services at 6.0% yoy, also a smudge above consensus. This same theme played out with headline inflation that came in at 3.2% yoy, a tenth above both consensus and the BoE’s forecast.

However, bets on cuts in the UK have continued – based partly on the BoE’s consistently optimistic (and, let’s be honest, consistently wrong) projections for the forward path of inflation.

To an even greater extent than the ECB, the BoE is staking a claim on inflation fluttering down to target from still quite elevated levels even if they begin to ease rates due to the labor market rebalancing that's taking place and the anemic growth backdrop. It's a bit bold since inflation is still well above target.

Goldman forecasts that the ECB and BoE will do three consecutive cuts starting with the June meeting before then switching to a quarterly pace until the neutral rate is hit (GS anticipates two Fed cuts in 2024, which is pretty inline with current market pricing, although there are some like Barclays that think the Fed will only manage to cut once in 2024).

If a no landing scenario in the US becomes the consensus view would you go more overweight or underweight cash, treasuries, and equities?

Markets are complicated, so making broad brush generalizations about how a no landing scenario becoming a more consensus view will impact broad asset classes is a bit of a fool's errand. But there are a few high level things we can say with (somewhat) certainty...

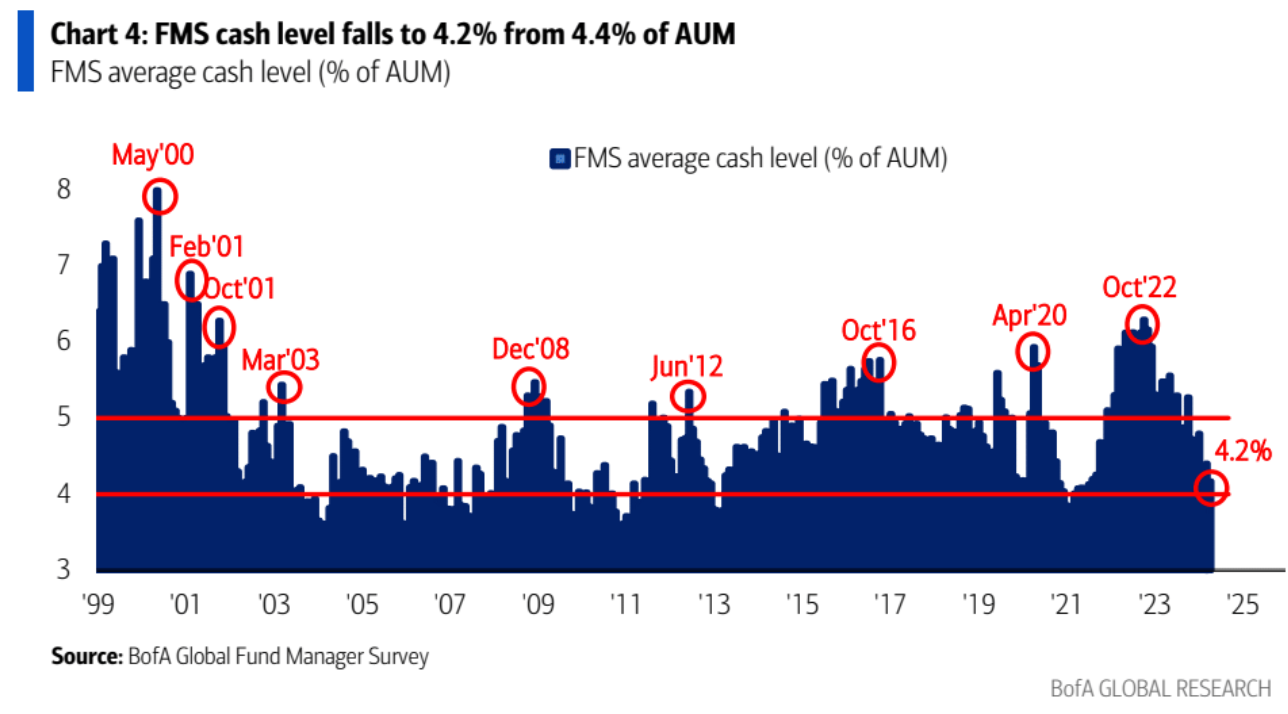

When a recession seems inevitable, as market participants believed in late-2022 and early-2023, two broad things happen: risk assets trade down and market participants begin fleeing to safe havens (i.e., treasuries and cash). And, of course, that’s exactly what we saw through 2022 and into early-2023 as the riskiest equities (i.e., meme stocks) were crushed and cash allocations reached two-decade highs among market participants (as a % of total AUM managed).

However, right now cash allocation – per BofA’s client survey – is around the lowest it’s been for the past decade (nearly matching the lows at the height of the equities mania in 2021). So, the obvious question is where is all this cash that was on the sidelines being allocated?

Well, in a soft-landing scenario then both treasuries and equities have some appeal. Because in a soft landing one would expect yields to fall (and prices rise) as rates normalize. Likewise, with equities you’d expect that as growth continues, but rates normalize and act a positive tailwind, they’d increase too. And this is largely what we saw over the last year as a soft landing became more and more the consensus view: large inflows into both treasuries and equities, and both of these (especially the latter) were pretty good trades through 2023.

However, if we think a no landing scenario will become the consensus view, then what we’re saying is that we think the economy can grow at or above potential and that we’ll have at or above target inflation.

Or, put another way, a condition of a no landing scenario is that the Fed Funds rate isn’t actually that restrictive, and that few or no rate cuts are warranted (perhaps even an additional hike, as a minority are beginning to think, could be warranted to try to tamp down inflation that looks like it won't return to target any time soon – even NY Fed President Williams, a pretty big dove by Fed standards, today didn’t dismiss the potential that the Fed’s next move may have to be up if the “data” warrants it).

Therefore, in a no landing scenario we wouldn’t be a huge fan of holding treasuries (especially far out the curve) because in a world where the consensus becomes that rates at their current level are fine or even that they’re not restrictive enough then we’d expect the yield curve to at least partially revert to a more normal shape (not be so inverted). And since when yields go up, prices go down, that wouldn’t be ideal for us (we've already seen significant yield increases across the belly and long-end of the curve this year).

But when it comes to equities, higher than expected growth and even higher than expected inflation (since the flip side of inflation is at least some companies having pricing power) could be a net benefit, and we’d thus expect inflows into equities to likely increase.

Especially because in a no landing scenario holding treasuries isn’t as appealing as in a soft landing or hard landing scenario, and because a no landing scenario means that inflation is still elevated so you don’t want to just be sitting on cash. In other words, in a no landing scenario you have to put your cash to work somewhere – and a lot of the obvious fixed-income choices (unless it’s floating rate debt) wouldn’t look too appealing from a real return perspective.

Based on BofA’s survey of clients, it’s clear that the heightened belief in a no-landing scenario isn’t completely hot air – market participants are allocating increasingly inline with a belief it could occur. Remember from the chart earlier that through 2023 there was hardly anyone that believed in a no landing, whereas in just the last few months it’s steadily risen to 34% now. Based on this, we’d expect that fund managers have begun going more overweight equities and more underweight bonds – and lo and behold…

I should note that we have seen a significant equity sell-off this week but, of course, a no landing scenario isn't a consensus view right now either. As always, what moves markets is a lengthy list of factors that are impossible to truly disentangle and certainly part of the sell-off we've seen is driven by the fact that part of the equity gains we've seen over the last six months have been based on the anticipation of future rate cuts, not the anticipation of future earnings growth based on strong economic growth. So as equity markets have truly internalized (after suspending belief for the last few months) that it does look like we'll have few cuts, if any, this year there's been a significant rejiggering in equities occurring along a number of different axis.

I should also note, even though it's outside the question, that in a global no landing scenario (or even just a no landing scenario in the US) you’d also expect commodity prices to pick up significantly from where they were in 2022 and into early-2023 when market participants anticipated a recessionary environment to prevail.

And while some commodities (i.e., oil) have had a larger geopolitical risk premium priced into them as of late (GS thinks the geopolitical risk premium priced in right now is around $5-10/bbl), commodities overall have seen significant gains (from metals to agriculture) to start the year as market participants have become more optimistic about the global growth outlook...

Conclusion

Market participants have become used to major central banks (with the exception of the BoJ, because they’re always dancing to the beat of their own drum) largely moving in unison. So to start the year it was expected that despite the different inflation and growth backdrops that exist in the US, the UK, and the Euro area that we’d somehow see a similar level of rate cuts beginning at a similar time.

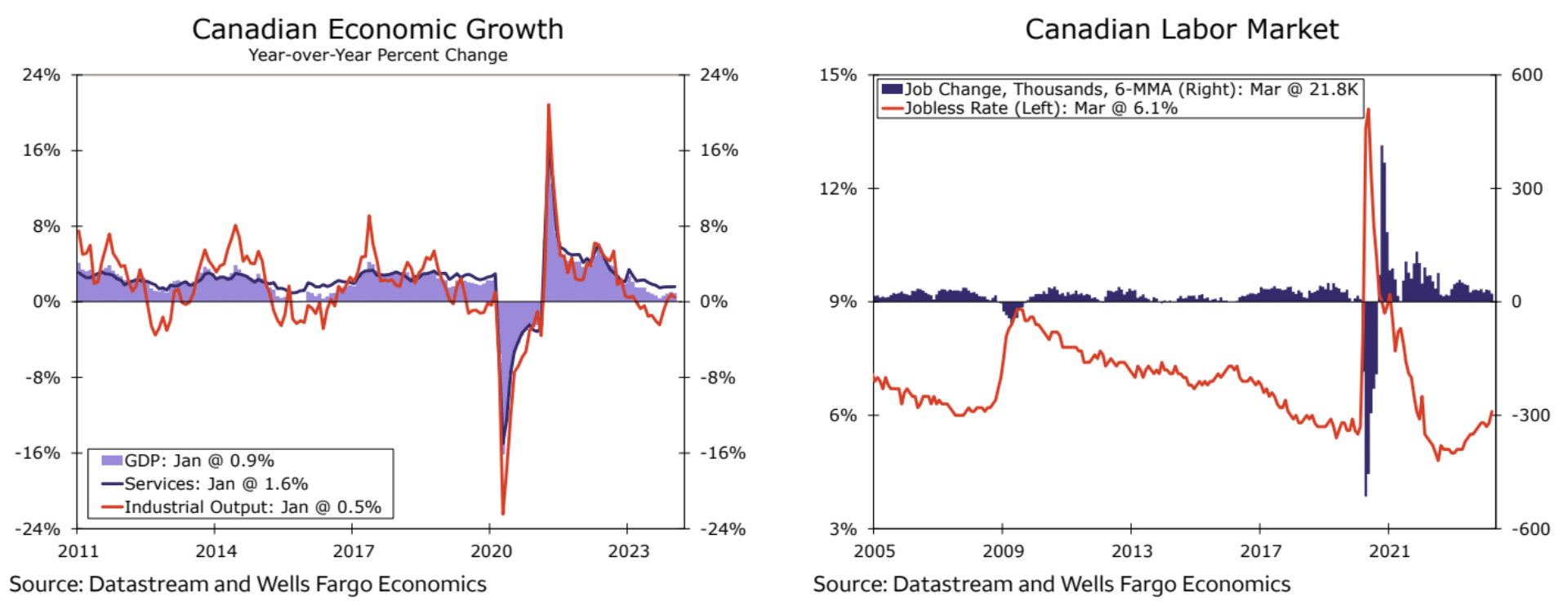

But we’re beginning to see what looks like the start of real divergence, and for some (like Canada) that raises a whole host of difficult questions. Namely, whether no longer moving in relative lockstep with the US and beginning the cut cycle before them - because of a weaker economic backdrop and relatively modest inflation right now - will depreciate CAD so much that it’ll begin to import inflation back in and therefore force the BoC to pause the cut cycle or even begin hikes again (even if further cuts are warranted based on the weak economic backdrop).

Crédit Agricole’s global markets program runs a bit under the radar, but they’ve expanded their footprint outside of the EU significantly in the last decade. So if you’re currently preparing for interviews at Crédit Agricole – whether in the US or the Euro area – make sure to review all the classic types of sales and trading interview questions (not just market-based ones).